Does the Fed’s monetary policy and interest rates influence Bitcoin and cryptocurrencies?

In the world of digital finance, the decisions of central banks, and in particular the United States Federal Reserve (Fed), have a profound impact not only on traditional markets but also on the trend of cryptocurrencies.

Despite being decentralized, Bitcoin (BTC) and other digital assets are significantly affected by interest rate changes and monetary policies that regulate global liquidity. Understanding how and why Fed rates influence cryptocurrencies is therefore essential for anyone investing or operating in the crypto sector.

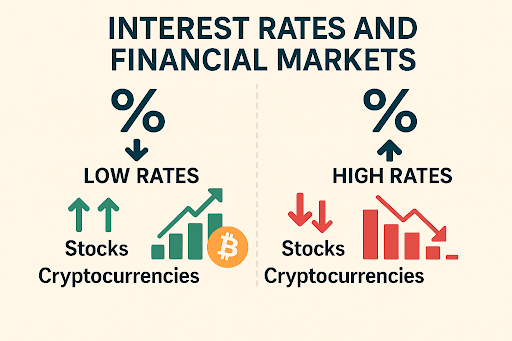

Interest rates as a lever of financial markets

Interest rates represent the cost of money. When the Fed decides to raise them, borrowing becomes more expensive, liquidity decreases, and investments in risky assets tend to decline. Conversely, low rates favor access to credit and push capital towards more speculative instruments, including cryptocurrencies.

Figure 1 – Effect of interest rates on financial markets.

Figure 1 – Effect of interest rates on financial markets.

Bitcoin, devoid of fixed yield, behaves similarly to a “risk-on” asset: its value tends to rise when investors seek alternative returns and falls when they prefer to revert to government bonds or safer bonds.

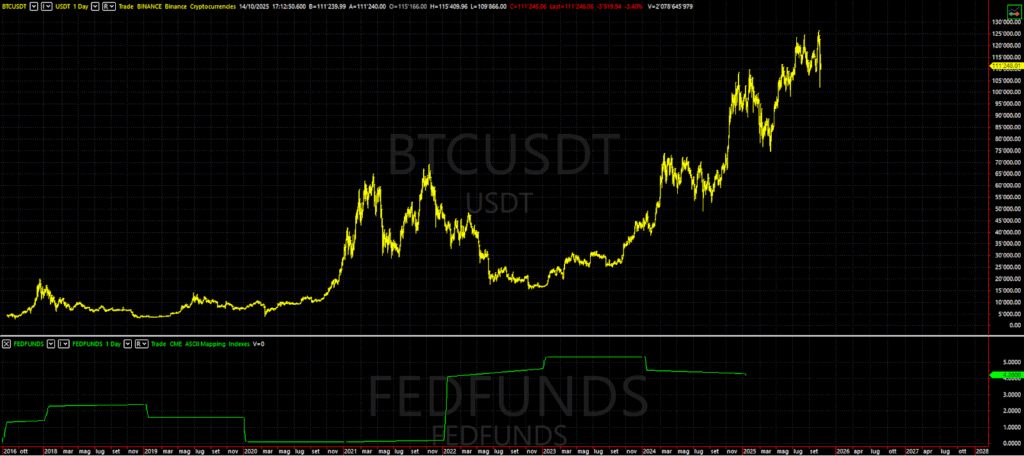

During periods of expansive monetary policy, such as in the years 2020-2021, near-zero rates and ample liquidity supported an unprecedented boom in the crypto market. With the monetary tightening of 2022, however, the price of BTC collapsed, demonstrating the strong correlation between Fed policy and the sector’s performance.

This is clearly visible in Figure 2, where the trend of Bitcoin is shown in comparison to the FED rates on the same chart.

Figure 2 – Bitcoin price chart in relation to interest rate trends.

Figure 2 – Bitcoin price chart in relation to interest rate trends.

The Opportunity Cost and the Appeal of Risk

The relationship between interest rates and cryptocurrencies is largely explained through the concept of opportunity cost. When the returns offered by government bonds are low, investors are driven to seek more profitable, albeit risky, alternatives such as Bitcoin. Conversely, when rates rise and bonds start offering attractive gains again, capital tends to flow back towards safer investments.

2022 was a clear example of this. With US rates rising rapidly and a high inflation environment, Bitcoin lost over 60% of its value (see Figure 2), confirming how the Fed’s monetary policy can directly affect market sentiment and the choices of market operators.

Liquidity and Leverage: The Engine and the Trap of the Crypto Market

The cryptocurrency market thrives on liquidity. When credit is abundant and rates are low, investors can easily access capital to use in speculative or leveraged operations.

This dynamic fuels price growth and drives innovation, as happened with the explosion of decentralized finance (DeFi), where loans and high yields multiplied thanks to the excess of global liquidity.

But with the increase in rates, the scenario changes radically. Money becomes more expensive, leverage is reduced, and more exposed operators are forced to liquidate their positions. This is what happened in 2022, when platforms like Celsius and BlockFi collapsed under the weight of evaporated liquidity and increasingly difficult debts to sustain. The monetary tightening, therefore, not only cools prices but can also jeopardize the stability of the entire crypto ecosystem.

The Surprises from the Fed and Bitcoin Volatility

The cryptocurrency market does not only react to the official decisions of the Fed, but also to the expectations and signals that anticipate its moves. The words of President Jerome Powell can influence the trend of Bitcoin just as much as a change in rates.

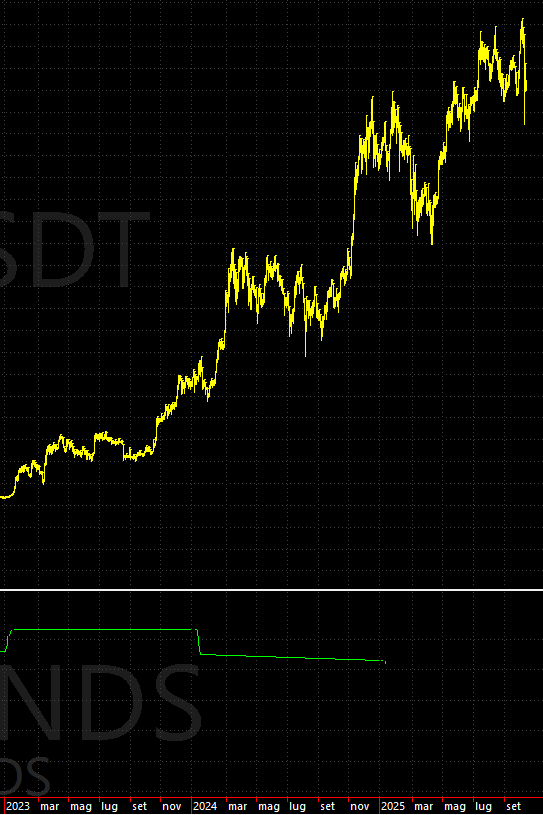

When the Fed adopts a more rigid or “hawkish” tone, investors tend to reduce risk exposure; however, when the language becomes more accommodating or “dovish“, sentiment improves and cryptocurrencies regain momentum.

In the summer of 2023, for example, just a hint of a possible pause in rate hikes was enough to trigger a strong recovery in Bitcoin and Ethereum. Rate expectations have thus become one of the main drivers of volatility in the crypto market.

Figure 3 – Example of Bitcoin recovery (2023) in response to a hint of a pause in interest rate hikes.

Figure 3 – Example of Bitcoin recovery (2023) in response to a hint of a pause in interest rate hikes.

Bitcoin and Inflation: Between Myth and Reality

For years, Bitcoin has been described as a potential “safe haven asset” against inflation, thanks to its limited supply and the deflationary nature of the protocol. However, recent years have challenged this narrative.

During the high inflation phase between 2021 and 2022, Bitcoin did not behave like gold but lost value, following the trend of tech stocks. The reason is that the rate hikes decided by the Fed to counter inflation reduced liquidity and pushed investors towards more stable assets.

In the long term, Bitcoin could still maintain a store of value function, but in the short term, it appears more sensitive to economic cycles and monetary policies rather than consumer price levels.

The Echo of Rates in Decentralized Finance

Decentralized finance is also affected by the Fed’s decisions, even though it is not directly linked to the banking system.

In DeFi protocols, interest rates are formed algorithmically, based on the demand and supply of liquidity. However, when global rates rise and “safe” yields become more attractive, liquidity tends to flow out of decentralized protocols towards the traditional system. In this sense, DeFi represents a digital reflection of global finance: it cannot disregard the macroeconomic dynamics that determine the cost of capital.

The New Link Between Macroeconomics and the Crypto Market

With the maturation of the sector and the entry of institutional investors, Bitcoin is increasingly influenced by macroeconomic variables. Today investment funds, ETFs, and listed companies treat BTC as a full-fledged financial asset, subject to the same factors that move stocks and bonds: economic growth, inflation, and, naturally, monetary policy.

This makes the crypto market an integral part of the global economy. Technological decentralization does not mean independence from economic mechanisms: on the contrary, Bitcoin has become a sensitive thermometer of the decisions made in central bank headquarters.

Conclusion: An Inevitable Link Between Bitcoin and the Fed

Today it is impossible to analyze the cryptocurrency market without considering the impact of the Federal Reserve’s decisions. Interest rates influence capital flow, risk appetite, and ultimately, the value of Bitcoin. When rates are low, liquidity is abundant and the market tends to grow. Conversely, when they increase, credit tightens, speculation decreases, and prices are affected.

The surprises from the Fed continue to generate volatility, while inflation and restrictive policies exert bearish pressure on digital assets. As long as the dollar remains the world’s reserve currency, the Fed’s decisions will continue to shape the crypto universe. Those who truly want to understand where Bitcoin is heading must learn to read not only the charts but also (and perhaps most importantly) the FOMC statements.

See you next time and happy trading!

Vous aimerez peut-être aussi

Cardano Latest News, Pi Network Price Prediction and The Best Meme Coin To Buy In 2025

Zions Bancorporation lost nearly $1 billion in market value after revealing a $50 million fraud‑linked loan loss