ETH's strong rebound drives the Ethereum staking track to heat up, and the leading protocols accelerate market recovery

Author: Nancy, PANews

In recent days, Ethereum has pulled out a big positive line, which has greatly boosted the morale of the "E Guards" and the market's bullish sentiment has rapidly heated up. This wave of strong pull-ups has not only brought about a comprehensive recovery in the Ethereum ecosystem, but also further heated up the market's expectations for the staking function of Ethereum spot ETFs, especially related staking projects have become a hot spot for capital chasing.

Ethereum rebounds strongly, and ETF pledge expectations drive confidence to recover

Recently, Ethereum has experienced a strong rebound for several consecutive days, and its total market value has surpassed Alibaba, ranking 39th in the world in terms of asset market value. The related surge topic even topped the Douyin hot list and became the focus of market discussion.

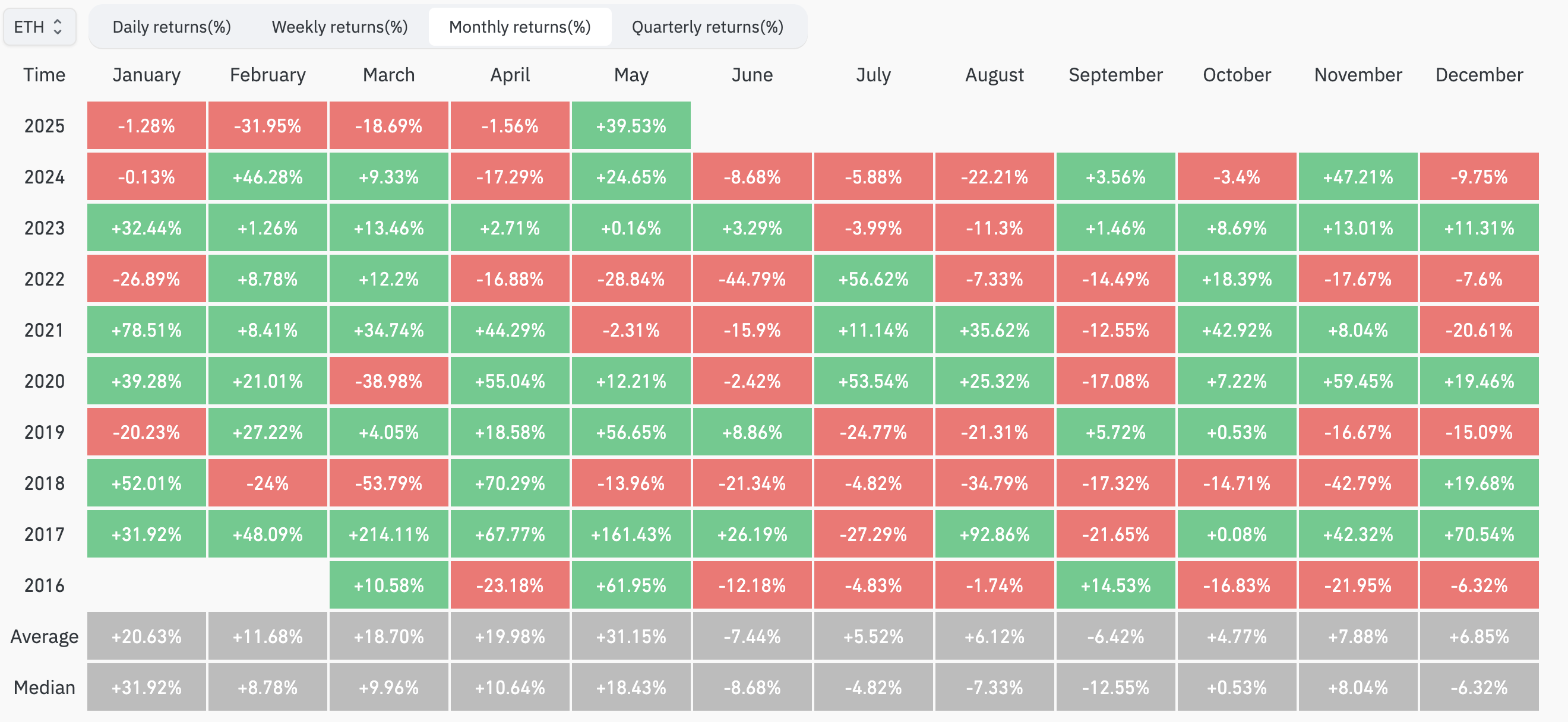

According to Coingecko data, as of May 12, the price of Ethereum rose to $2,521, a two-month high, with a 40.4% increase in the past seven days alone, and a market value surge of more than $87.58 billion in a single week. At the same time, Coinglass data shows that as of press time, Ethereum's monthly return rate in May has reached 39.53%, not only setting the strongest monthly increase since 2025, but also significantly surpassing the median increase (18.43%) and average increase (31.15%) in May of previous years. This round of strong rebound not only ended Ethereum's three-month downward trend, but also became a phased turning point for the significant recovery of market sentiment, showing a simultaneous recovery of capital and investment confidence.

The on-chain fund movement further verifies this trend. Artemis data shows that in the past 7 days, the Ethereum ecosystem has attracted an inflow of up to $1.2 billion, ranking first among all blockchains. Among them, the net inflow of funds exceeded $490 million, far ahead of other mainstream public chains.

The rebound is believed to be caused by the resonance of multiple factors, including marginal improvements in macroeconomic policies, price repair of previous excessive bearish sentiment, the upcoming Ethereum Pectra upgrade, the continued expansion of the reality narrative, and positive expectations for Ethereum spot ETF staking.

Among them, the ETF pledge function is expected to become one of the important catalysts. In the past few months, many institutions have actively sought approval from the SEC to allow the introduction of a pledge mechanism in crypto ETF products. Although the SEC has recently postponed the approval of applications from Fidelity, Grayscale and other institutions, related discussions are accelerating.

At the end of April this year, Grayscale met with the US SEC Crypto Working Group in Washington, DC to discuss changes in the pledge regulation of Ethereum ETP, stating that the total assets managed by the US Ethereum ETP reached US$8.1 billion, but due to the inability to participate in pledge, it has lost about US$61 million in revenue from its launch to February 2025. The agency pointed out that the introduction of a pledge mechanism will help improve the security of the Ethereum network while bringing additional returns to shareholders.

Another asset management giant, BlackRock, also met with the SEC Crypto Working Group recently, covering topics such as crypto asset regulation, ETF pledge and options products. The document shows that the meeting discussed "considerations for promoting ETPs with pledge functions", and discussed the parameters for determining crypto ETF option positions and exercise limits, as well as specific standards for approving crypto ETFs. Among them, Robert Mitchnick, head of BlackRock's digital assets, who attended the meeting, said in March that if the Ethereum spot ETF can add a pledge function, although there are some "complex challenges" that need to be solved, pledge income is an important way to obtain investment returns in this field, which may become "a leap forward turning point" for Ethereum.

It is worth noting that Hong Kong regulators have taken a step ahead on the issue of crypto ETF pledge. In April this year, the Hong Kong Securities and Futures Commission (SFC) issued new guidelines to allow licensed virtual asset trading platforms (VATPs) to provide pledge services to customers. At the same time, virtual asset funds (such as Ethereum spot ETFs) can participate in on-chain pledge activities under the prudent regulatory framework, and subsequently approved two Ethereum spot ETF products with pledge functions.

The positive progress of these ETF staking has effectively boosted market expectations for Ethereum and further accelerated the process of confidence restoration.

The staking track has heated up significantly, and the TVL and coin prices of leading projects have soared

The Ethereum staking track has also become one of the key areas of focus for funds and narratives. DeFiLlama data shows that as of May 12, the TVL of the Ethereum staking track has rebounded to US$34.11 billion, a 60.3% increase in the past month. At the same time, the TVL of the re-staking track has also risen to nearly US$12.85 billion, an increase of 54.8% in the past 30 days.

In this article, PANews reviews the latest market trends and market performance of the five leading staking projects in the Ethereum ecosystem. Overall, breakthroughs have been made in technological progress, governance mechanisms, and ecological construction, which have promoted the recovery of the overall market. Both TVL and token prices have achieved double-digit growth.

Lido: TVL soars to nearly $23 billion, driven by technology and governance

Lido is the largest liquidity pledge protocol. According to DeFiLlama data, as of May 12, Lido's TVL was approximately US$22.93 billion, an increase of 57.5% in the past month. At the same time, Coingecko data showed that its native token LDO also rose by about 48.6% during the same period.

In recent months, Lido has made progress in both governance and technology. In April, Lido DAO launched multiple governance votes, including Snapshot votes and Aragon main phase votes, involving protocol updates and decisions. In the same month, Lido also launched the V3 testnet, where developers can create customized staking solutions using Lido stVaults on the Hoodi Ethereum testnet. Lido stVault is a modular primitive that allows stakers, node operators, and protocols to customize staking solutions according to their needs. Users can customize fee structures, verification settings, optimize risk/reward structures, and more, while retaining the advantages of stETH. Not long ago, Lido announced the upcoming launch of a "dual governance" mechanism, a dynamic time lock mechanism that allows stETH holders to exit Lido on Ethereum in the face of controversial Lido DAO governance motions.

It is worth mentioning that, despite the recent concern about the suspected leakage of Chorus One's oracle private key, Lido DAO has immediately launched an emergency proposal, and the pledged users have not been affected, and the protocol is still safe and operating normally. At the same time, since the Lido oracle system adopts a 9-choose-5 multi-signature mechanism, a single oracle failure will not threaten the system, and the remaining nodes are not affected.

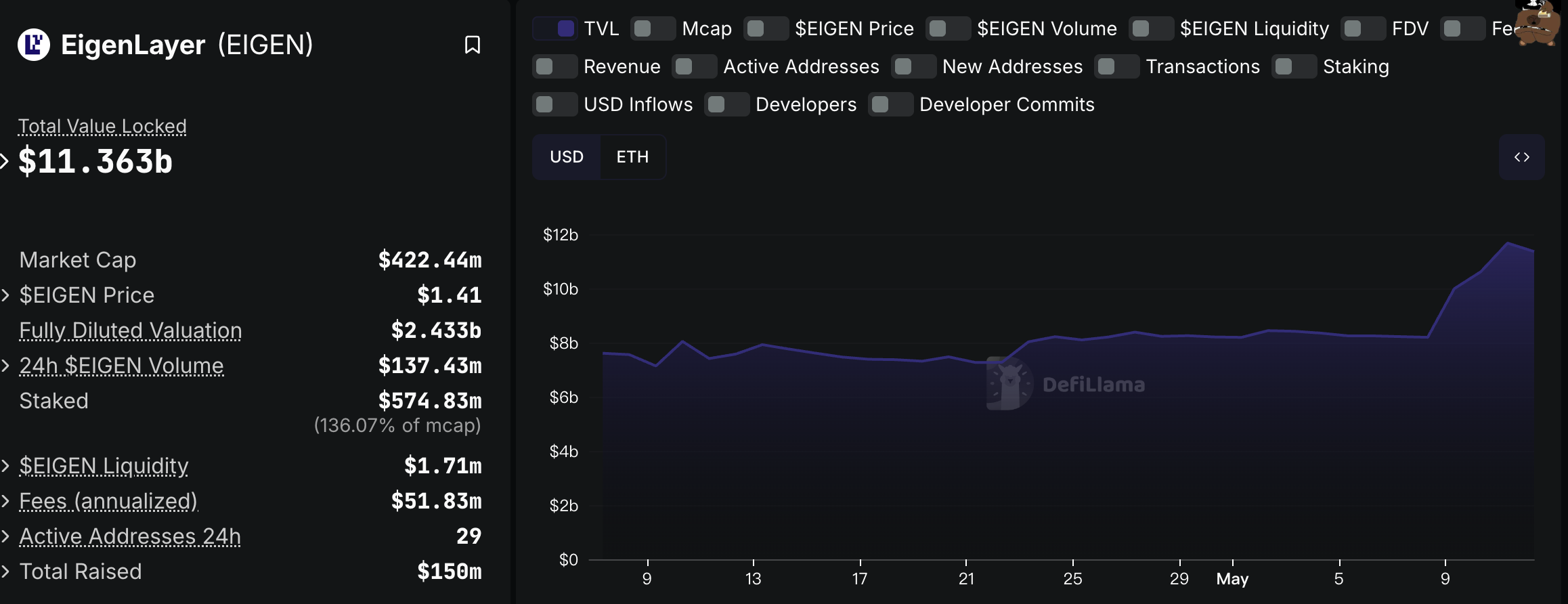

EigenLayer: Multi-line advancement boosts coin price and TVL

EigenLayer continues to be the leader in the re-staking track. DeFiLlama data shows that as of May 12, EigenLayer's TVL reached US$11.36 billion, an increase of about 52% in the past month. At the same time, Coingecko data shows that its native token EIGEN has risen by 69.7% in the same period.

In the past two months, EigenLayer has continued to advance in technology upgrades, developer ecology, and application expansion. In mid-April, EigenLayer's Slashing (penalty mechanism) was officially launched on the mainnet. After the upgrade, operators and pledgers using the EigenPod CLI need to upgrade the checkpoints. At the same time, each application verification service (AVS) can now directly implement the penalty conditions on the mainnet. Soon after, EigenLayer announced that it will launch the Redistribution function, bringing new capabilities to its Slashing upgrade. This function allows the decentralized verification service (AVS) to redistribute funds after the pledged funds are punished, rather than directly destroying them, thereby supporting more complex use cases such as lending and insurance agreements. The first batch supports non-ETH assets (such as LSTs, EIGEN, USDC, and AVS tokens). ETH is not yet supported and is scheduled to be launched on the Ethereum mainnet in June. In recent days, EigenLayer announced its participation in the Ethereum Pectra upgrade on May 7 to support Ethereum network improvements, and plans to introduce new features such as validator integration for EigenPods, as well as plans to hold the "Berlin Hacker Village" in Berlin to attract global developers to build the next generation of verifiable applications.

Rocket Pool: From node incentives to ecological integration, driving TVL and coin prices up

Rocket Pool is also one of the most watched Ethereum staking protocols. According to DeFiLlama data, Rocket Pool's TVL reached $1.74 billion, up about 56.3% in the past month. At the same time, Coingecko data showed that its native token RPL rose by about 67.5% during the same period.

In the past two months, Rocket Pool has mainly focused on technology upgrades, community governance, and DeFi ecosystem expansion. For example, in March, Rocket Pool announced the distribution of 133 ETH to node operators, and emphasized that the pool is free to join and has no usage fees to attract more participants; in April, Rocket Pool released a Smart Node update and held a community call to discuss whether DAOs should raise funds through bridge fees, share quarterly product development roadmap updates, and promote the integration of rETH in DeFi protocols; in May, Rocket Pool actively promoted node software updates to support Pectra upgrades and launches.

Symbiotic: TVL exceeds US$1 billion, receives tens of millions of dollars in financing

Symbiotic, a re-pledge protocol, mainly emphasizes modular security and capital efficiency. According to DeFiLlama data, Symbiotic's TVL has exceeded US$1.09 billion, an increase of about 45% in the past month.

In the past two months, Symbioticfi has continued to advance its universal re-pledge agreement and has made positive progress in financing recently. In April, Symbiotic announced the completion of a $29 million Series A financing round, with participation from institutions such as Paradigm, CyberFund, Pantera Capital and Coinbase Venture. In the same month, ether.fi announced the launch of a $40 million crypto venture capital fund, with Symbiotic as one of its first investment projects.

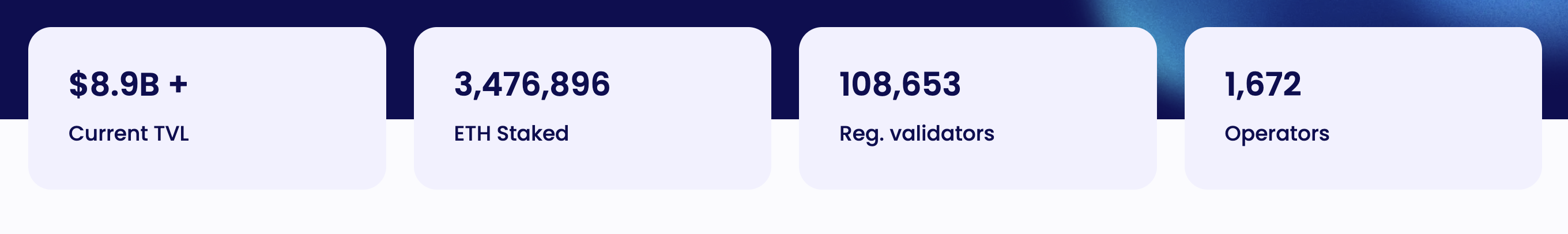

SSV Network: Coin price increased by more than 90% in the month, and active validators exceeded 100,000

The official website shows that as of May 12, the TVL of SSV Network has exceeded 8.9 billion US dollars, and the number of ETH staked is close to 3.467 million. Coingecko data shows that in the past month, its token SSV has increased by as much as 91.6%.

Recently, SSV Network announced that its active validators exceeded 100,000, accounting for about one-tenth of Ethereum validators. This tweet was forwarded and supported by many partners such as Lido, Renzo, Kraken, ChainLayer, HashKey Cloud, Nansen, Swell and Eigenpie. At the same time, SSV Network announced on May 6 that the SSV 2.0 test network was launched on Hoodi, aiming to significantly improve the security of the Ethereum ecosystem by introducing the concept of "based on applications" (bApps), while reducing the security cost of developers by up to 90%, and providing risk-free returns for validators, thereby unlocking more value for the entire ecosystem.

Vous aimerez peut-être aussi

Five marriages, a prodigal son: The wild life of 81-year-old billionaire Larry Ellison

SharpLink transfers $379 million in stablecoins to Galaxy Digital wallet