Hong Kong SFC Regulated Exchange Lists BNB for Professional Investors

Hong Kong’s OSL HK, a digital asset platform regulated by the Securities and Futures Commission (SFC), has opened BNB trading services. The launch introduces three trading pairs: BNB/USD, BNB/USDT, and BNB/USDC. BNB deposits and withdrawals are already available through the BNB Chain network. According to the company’s announcement, trading begins on September 3, 2025, at 15:00 (UTC+8). For now, the service is limited to professional investors. The exchange has not yet provided any details on when BNB trading will be available to retail customers. Strategic Push from China Renaissance The OSL HK listing comes against a backdrop of growing institutional involvement in the BNB ecosystem. China Renaissance Holdings Limited, a Hong Kong-listed financial services group, recently signed a non-binding Strategic Cooperation Memorandum with YZi Labs. Under the agreement, China Renaissance will commit approximately $100 million toward BNB-related investments. This move makes it the first Hong Kong-listed company to add BNB to its portfolio. It also represents a symbolic step for the regionally regulated crypto market. The partnership seeks to generate sustainable yields from the BNB ecosystem while securing long-term exposure to leading blockchain projects. It will also prioritize expanding Web3 initiatives and encouraging the regulated listing of BNB on licensed exchanges in Hong Kong. China Renaissance has also teamed up with China Asset Management (Hong Kong) and other ecosystem players. Together, they aim to expand regulated access to BNB through investment products that can reach a wider base of institutional and professional investors. BNB Price and Market Trends BNB, the native cryptocurrency of the BNB Chain, has continued to show strong market performance in 2025. On August 23, 2025, the token hit a record high of $899.70. As of press time, BNB trades at $852.63, representing a 5.16% dip from its peak. With a market capitalization of $118.78 billion, BNB currently ranks as the fifth-largest cryptocurrency globally. Its continued strength has attracted attention not only from retail traders but also from large financial institutions seeking diversified exposure to digital assets. Global Expansion and Adoption The momentum for BNB isn’t limited to Hong Kong. Just a day before its record high, RAKBANK in the UAE announced support for direct BNB trading on its mobile banking platform. This development makes RAKBANK the first traditional bank in the UAE to allow customers to buy and sell BNB directly from local accounts. The move signals a broader trend where established banks are beginning to integrate digital assets into mainstream financial services.

Vous aimerez peut-être aussi

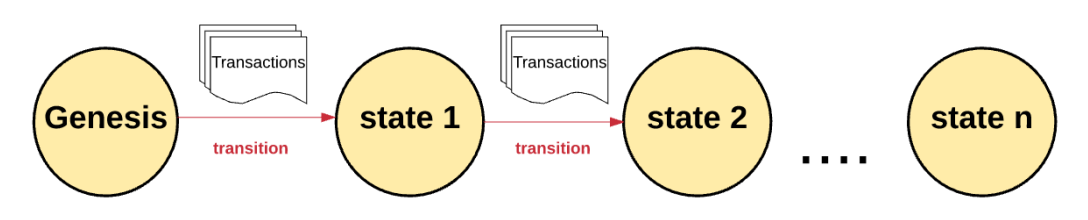

Ethereum Is More Than Just “Crypto”

Stake, Win, Repeat: Best Crypto Casinos That Dominate Web3 Gambling in 2025