Lyft, Inc. ($LYFT) Stock: Reserves Tensor Auto Robocars, Shares Down 3.19%

TLDRs:

- Lyft reserves Tensor Auto Robocars for 2026, shares drop 3.19% on cautious investor outlook.

- Robocars feature 100+ sensors and Nvidia chips, designed for Level 4 autonomous city driving.

- Fleet rollout hinges on permits; Flexdrive will manage cleaning, charging, and maintenance.

- European FREENOW acquisition expands market reach, giving Lyft global operational scale.

Lyft, Inc. ($LYFT) is making a bold move into the autonomous vehicle (AV) market, reserving several hundred Robocars from Tensor Auto, a San Jose-based AV startup originally spun out of China’s AutoX.

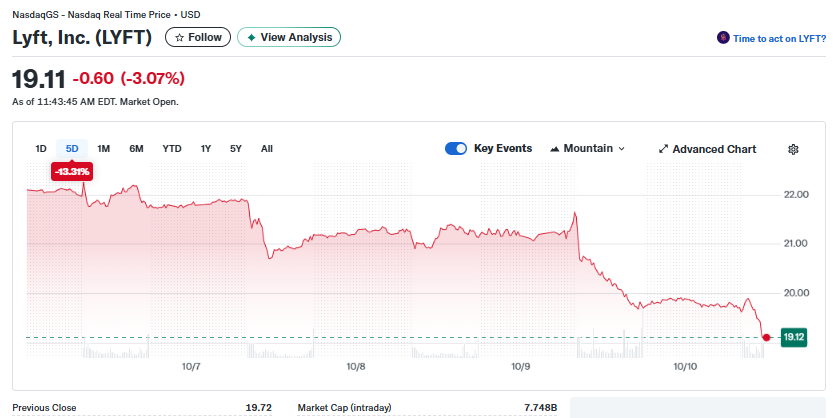

The announcement comes as shares of the ride-hailing giant fell 3.19% to $19.09 in early trading Friday, reflecting cautious investor sentiment about the high-risk, high-reward nature of autonomous transportation.

The vehicles are scheduled for production in Vietnam through a partnership with VinFast, with Lyft’s platform pre-installed for seamless integration in cities allowing Level 4 AV operations. These cars boast over 100 sensors, including cameras, lidars, and radars, alongside eight Nvidia Blackwell-based chips to manage real-time data processing. Tensor Auto expects the first units to roll off the production line by late 2026, aiming for commercial deployment in 2027.

Lyft, Inc. (LYFT)

Lyft, Inc. (LYFT)

Lyft Secures Future Autonomous Vehicles

This marks Lyft’s first direct reservation and planned operation of its own autonomous fleet. Previously, Lyft had relied on partnerships with Waymo and May Mobility to experiment with AV services in limited regions.

The direct reservation strategy signals Lyft’s intention to gain greater control over technology integration, operational efficiency, and customer experience in its future AV offerings.

The Robocar’s sensor suite is designed for maximum situational awareness, ensuring safe navigation in complex urban environments. The use of eight high-performance Nvidia chips highlights Lyft’s focus on robust on-board computing to process massive amounts of real-time data. Tensor Auto and Lyft believe this combination will support a safer, more efficient autonomous ride-hailing experience than previous third-party integrations.

Fleet Launch Dependent on Permits

Despite the progress, the commercial rollout hinges on regulatory approvals that are not yet secured. While Tensor holds a California driverless testing permit allowing trials without a human driver, it lacks deployment authorization for carrying paying passengers without safety operators.

Only Waymo currently holds such approval. Lyft also plans to set up fleet operations through its Flexdrive division, managing vehicle cleaning, charging, and maintenance. In addition, property owners near deployment zones can build dedicated charging hubs, with Nashville slated for Lyft’s first autonomous depot.

European Expansion Shapes Strategy

This domestic AV strategy is part of Lyft’s broader expansion, including its recent acquisition of European mobility platform FREENOW.

The move extends Lyft’s footprint to 11 countries and nearly 1,000 cities. FREENOW operates primarily in taxi-heavy European markets, giving Lyft access to regulatory relationships and operational infrastructure critical for scaling across international markets. Analysts note that Lyft’s acquisition-driven expansion strategy favors long-term market presence over immediate revenue gains, doubling its addressable market for personal vehicle trips.

With a combination of domestic AV innovation and international expansion, Lyft is positioning itself for the next frontier in ride-hailing, even as regulatory hurdles and investor caution temper immediate optimism. The coming years will reveal whether Lyft’s autonomous ambitions can translate into tangible market leadership and shareholder value.

The post Lyft, Inc. ($LYFT) Stock: Reserves Tensor Auto Robocars, Shares Down 3.19% appeared first on CoinCentral.

Vous aimerez peut-être aussi

Fan Token Firm Chiliz Acquires 2-Time ‘Dota 2’ Champions, OG Esports

Facts Vs. Hype: Analyst Examines XRP Supply Shock Theory