More Than $1 Billion in Leveraged Bets Wiped out; Whale Trader Loses $83M in ETH Liquidation

The crypto market’s sharp decline on Aug. 14 resulted in over $1 billion in liquidations within 24 hours.

Inflation Fears Fuel Market Crash

The crypto market’s unexpected descent shortly after reaching yet another milestone saw more than $1 billion in short and long bets being wiped out in just 24 hours. According to Coinglass data (August 14 at 10:30 p.m. EST), liquidated long positions accounted for more than $872 million of total liquidations, with shorts accounting for the remainder.

The release of the July 2025 U.S. Producer Price Index (PPI) on August 14 appears to be a significant catalyst for the market downturn. The PPI report showed a larger-than-expected increase in wholesale prices, climbing 0.9% for the month and 3.3% over the past year. This was a notable jump from the previous month and the biggest monthly gain in three years.

This rise in wholesale prices has fueled concerns that the higher costs from the Trump administration’s tariff policies are now being passed on to consumers. Businesses, having absorbed some of the initial tariff costs, may now be increasing their prices to maintain profit margins. This has reignited fears of inflation, which in turn leads to speculation that the Federal Reserve may be less likely to cut interest rates.

As shown by the data, ethereum ( ETH) saw the highest total liquidations over the 24-hour period, with $272.29 million in long and $74.17 million in short positions being wiped out. Bitcoin ( BTC) followed with the next highest 24-hour liquidations, with $164.64 million in long liquidations and $13.16 million in short liquidations.

Notorious Whale Trader Suffers Major Loss

For BTC, ETH, SOL, and XRP, long liquidations were significantly higher than short liquidations over the 24-hour period, an indication that traders were betting on these cryptocurrencies continuing the momentum that saw the crypto economy’s market cap nearly top $4.3 trillion.

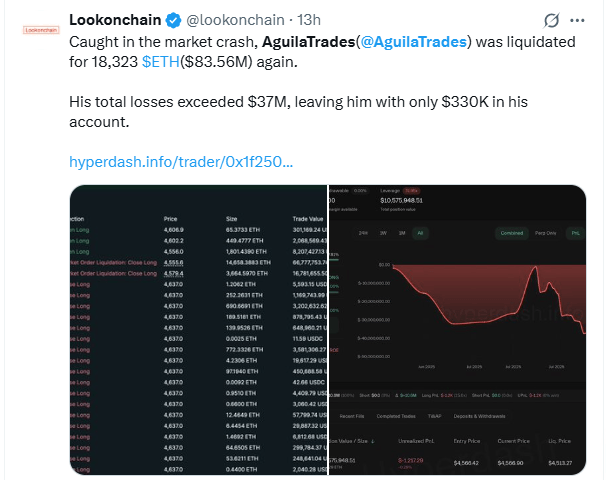

Meanwhile, the Aug. 14 market crash is said to have hit the mysterious whale Aguila Trader hard. According to Lookonchain, the trader was liquidated for 18,323 ETH ($83.56M), bringing his losses to more than $37 million and “leaving him with only $330K in his account.” This assessment was backed by another on-chain monitor on X who also revealed this to be the latest major loss for Aguila Trades.

“In one swift liquidation, 18,323 ETH vanished from his positions, a staggering $83.56 million gone in a blink. The sting was sharper knowing this wasn’t his first fall; losses had already piled up past $37 million. Now, the once-mighty trader’s account sat at just $330K—a shadow of what it once was,” Eyeonchain wrote on X.

Another X user suggested that Aguila Trades had lost more than $200 million a week earlier after shorting ETH with 15x leverage and a liquidation price of $4,383.

Vous aimerez peut-être aussi

Circle Touts $658 Million in Annual Revenue as Q2 Results Drop

Circle shares drop following forecast of $618 million revenue hit from rate cuts