Nasdaq Proposal Analysis: How Tokenized Securities Will Reshape the U.S. Stock Trading Ecosystem

Author: Aki Wu on Blockchain

On September 8, 2025, Nasdaq submitted a landmark proposal to the U.S. Securities and Exchange Commission (SEC), seeking to amend its exchange rules to allow tokenized securities to be traded on its market. This means that Nasdaq-listed US stocks like Apple and Amazon could potentially be listed, traded, and settled on Nasdaq in the form of blockchain tokens. If approved, this proposal would be the first time a major US stock exchange has permitted tokenized stock trading, marking the first large-scale introduction of blockchain technology into the core markets of Wall Street. This article will systematically review the key points of Nasdaq's proposal, the motivations behind it, the potential market shifts it could bring, its impact on the "US stock blockchain" initiative and related sectors, and explore the potential development paths for this innovative initiative.

Proposal Highlights: Detailed Explanation of Nasdaq Trading Rules Amendments

The core of Nasdaq's 19b-4 Rule amendments submitted to the SEC is to allow member brokerages and investors to choose to trade and settle Nasdaq-listed equity securities and exchange-traded products (ETPs) in tokenized form. Specifically, the rule amendments include the following:

1. Expanding the definition of “securities” to include tokenized forms of securities in Equity 1, Section 1

The proposal first amended the exchange’s definition of “securities,” emphasizing that “tokenized securities are still securities,” rejecting the “isolated” trading model that is decoupled from the main market and expanding it to include two forms:

Traditional form: This refers to a digital record of asset ownership and rights, but does not utilize distributed ledgers or blockchain technology. This refers to the electronic record-keeping method currently used in US stocks, which essentially still corresponds to the electronic registration of paper securities.

Tokenization: This refers to the digital representation of asset ownership and rights, recorded and transferred using blockchain (distributed ledger) technology. Simply put, the rights associated with a stock are issued on the blockchain and represented as tokens.

Nasdaq explicitly stipulates that a tokenized security is considered an equivalent security and can be traded on the same order book as its traditional counterpart only if it is fully homogeneous. This means that the token must be fungible with traditional shares, share the same CUSIP (Uniform Securities Identification Number), and confer upon the holder the same substantive rights and privileges as traditional shares—including rights to equity returns, dividends, voting rights, and the right to distribute residual assets upon liquidation. If the tokenized security does not confer the same rights as the original share (e.g., no voting rights, no shareholder equity), or does not share the same CUSIP, the exchange will not treat it as equivalent to the traditional security and will instead treat it as a different product, such as a derivative or American Depositary Receipt (ADR).

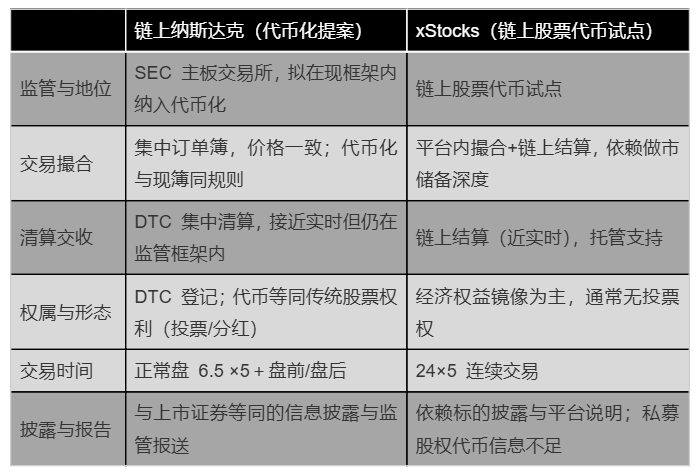

Because of this high standard, most so-called "tokenized stocks" currently on the market, such as Robinhood "Stock Tokens" and Xstocks, do not actually meet the above conditions. At best, they are just shadow tokens that reflect stock prices, do not represent real equity, and usually do not confer voting rights; dividends are mostly reflected in the form of reinvestment or cash equivalents; the legal relationship is mostly directed to the SPV or issuing vehicle rather than the listed company itself, and most products are mainly redeemed in cash. Direct "exchange for original shares" will be subject to custody and compliance restrictions.

2. Unified matching and distributed settlement: trading and clearing mechanism

Equity 4, Rule 4757

Nasdaq plans to fully integrate tokenized securities with traditional securities at the trading level. The proposal stipulates that as long as the tokenized version of a stock meets the aforementioned homogeneity requirements, it will share the same order book as traditional stocks and be matched according to the same order matching and priority rules. In other words, the exchange's matching engine will treat tokenized and non-tokenized buy and sell orders equally. Indeed, Nasdaq emphasizes that "at the trading stage, there is no difference between the two; the fundamental trade execution process is identical."

Equity 4, Rule 4756、4758

The difference lies in the settlement process. Currently, U.S. stock transactions are typically cleared and settled through the Depository Trust Company (DTC). By introducing tokenization, Nasdaq will offer trading participants a new option: they can use tokens for settlement. The specific process is as follows:

When brokers enter orders with the exchange, they can choose to specify that they wish to have their orders settled in tokens. If the order is executed and marked as token-settled, Nasdaq will pass the clearing instructions for the trade to DTC, which will then execute the security transfer in the background via blockchain.

DTC will register stock ownership as on-chain tokens based on its own business rules and systems (including its currently developing blockchain settlement platform). The entire process will be transparent to front-end investors. Trades will still be matched on Nasdaq, but clearing and settlement will shift from traditional electronic bookkeeping to blockchain-based registration. Ultimately, the shares will be held as tokens on-chain.

It's worth noting that Nasdaq's move isn't about creating a new market from scratch. Instead, it's leveraging existing market infrastructure, introducing blockchain as the underlying record-keeping technology without altering front-end trading mechanisms. This ensures that traditional stocks and tokenized shares maintain unified prices during trading, share market depth and liquidity, and maintain consistent information transparency and risk management. As Nasdaq explains in its filing, this plan aims to prevent different versions of tokenized shares from operating independently on multiple blockchains, fragmenting liquidity and ensuring that core mechanisms of the national market system, such as price discovery and best execution, are not impacted. This approach addresses the pain points of tokenized shares, including the lack of liquidity caused by the fragmentation of market-making capital and order books, resulting from multiple chains (ETH/SOL, etc.), multiple markets (regulated on-exchange trading versus crypto exchanges/DEXs), and geographical compliance restrictions.

3. Trading hours: 24/7 trading is not currently available

Since their launch, tokenized stocks have been plagued by issues of deep liquidity and high impact during US stock market holidays. This misalignment in trading hours has also contributed to insufficient liquidity and price decoupling. Consequently, many investors are concerned about whether tokenized stocks can transcend existing US stock market trading hours and achieve 24/7 trading. Nasdaq's proposal offers a cautious answer: at this stage, tokenized securities will only be traded during existing trading hours, with no extensions or breaks in trading hours. Tokenized stocks cannot be traded outside of regular or extended trading hours, and will continue to follow US stock market practices, trading only during regular trading hours (9:30–16:00) and pre- and post-market hours, Monday through Friday, Eastern Time. Weekend or late-night trading is not currently supported.

4. Implementation path of on-chain settlement

Nasdaq's tokenized stock trading relies on the Depository Trust & Clearing Corporation (DTC), a core clearinghouse in traditional financial markets. Notably, DTC has been exploring distributed ledger technology (DLT) clearing in recent years. Its "Project Ion" is a blockchain-based stock settlement platform designed to achieve T+0 and even real-time delivery. According to public information, Project Ion launched in a parallel pilot environment in 2022 and processes settlement instructions for over 100,000 stock trades daily. DTC developed the platform in collaboration with enterprise blockchain technology provider R3, using R3's Corda distributed ledger software and building a private permissioned blockchain as its underlying architecture. This network is a non-public consortium blockchain.

This suggests that Nasdaq's tokenized transactions are more likely to be run on DTC's permissioned blockchain platform, rather than on public blockchains such as Ethereum, which have been widely discussed in the community. This would allow DTC to maintain its legacy system as the authoritative record, running it in parallel with the new DLT system to ensure security redundancy. Therefore, under Nasdaq's proposal, on-chain settlement would likely occur within a controlled "consortium blockchain" environment, with nodes maintained by financial infrastructure operators such as DTC. This ensures transaction privacy, network reliability, and regulatory control, meeting Wall Street's high standards for trade settlement systems.

Consortium blockchains allow participants to undergo access control, ensuring greater control over data privacy and transaction speed, thus complying with regulatory requirements. Therefore, it is foreseeable that records of Nasdaq's tokenized shares will not appear on public blockchain explorers, but will instead be stored in a distributed ledger jointly maintained by Nasdaq, DTC, and related custodians. While Nasdaq has not specified the specifics of how its smart contracts will be deployed in its public documents, it is clear that Nasdaq does not intend to introduce a completely open token trading environment. Instead, it intends to utilize blockchain technology as a "behind-the-scenes" tool to enhance efficiency, while front-end transactions will still occur within a controlled system. The only change is to use blockchain records for bookkeeping. This means that investors will hold on-chain records approved by regulators, rather than crypto tokens that circulate freely outside the traditional system.

Why did Nasdaq apply for tokenized securities?

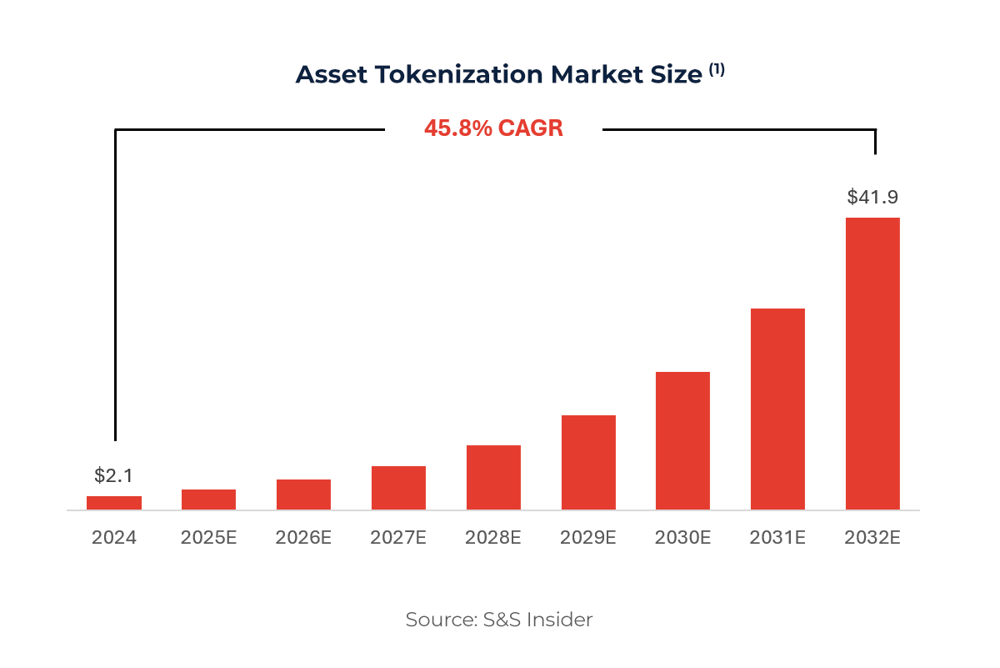

Blockchain has enormous potential to improve the efficiency of financial market infrastructure. Currently, US stock trades are settled on a delayed basis (T+1) (or T+2 in some markets). Blockchain technology can achieve near-real-time settlement (T+0 or even within seconds), reducing the time it takes for funds and securities to be held, and mitigating counterparty risk. Furthermore, blockchain's transparent and immutable distributed ledger provides a comprehensive audit trail, reducing reconciliation and manual errors. Nasdaq hopes to introduce tokenized settlement to expedite post-trade processes while reducing costs in clearing and custody. This is an attempt to revolutionize securities settlement mechanisms from the ground up. Nasdaq stated in its filing: "Today, securities, including stocks, have evolved from paper to electronic records, and tokenization is simply another method of digitally representing assets." By embracing blockchain, exchanges have demonstrated their determination to promote financial technology innovation so as not to fall behind in the new wave of technology. It is expected that the scale of the asset tokenization market is experiencing explosive growth, and the total market value of global tokenized assets will soar from approximately US$2.1 trillion in 2024 to approximately US$41.9 trillion in 2032, with a compound annual growth rate of 45.8%.

Consequently, investors and issuers are showing strong interest in security tokenization, which represents a significant emerging market opportunity. Regulators and market participants in many countries are actively exploring the potential of blockchain-based securities, and the US cannot afford to lag behind. As a market organizer, Nasdaq hopes to capitalize on this trend, offering clients new trading options and thereby attracting more capital to the US market. By taking an early approach, Nasdaq can solidify its competitiveness in the digital asset era, especially as the White House actively promotes crypto-asset innovation and fosters a digital asset-friendly regulatory environment. It is crucial to ensure that tokenized securities develop within a compliant framework and prevent market fragmentation. As mentioned earlier, many tokenized stocks are currently traded on unregulated offshore platforms, lacking investor protections. Different platforms operate independently, leading to fragmented liquidity and market opacity. Nasdaq's proposal aims to incorporate these innovations into the mainstream regulatory system, thereby preventing investors from being drawn into unregulated markets by chasing novel concepts.

While exchanges won't aggressively open up dazzling features in the short term, in the long term, stock tokenization opens up new possibilities for financial innovation. For example, stocks can be used as on-chain collateral in decentralized finance (DeFi), and equity tokens can be programmatically integrated into smart contracts to automate dividends, voting, and even the creation of entirely new derivatives and index products. These scenarios, difficult to achieve under traditional architectures, are expected to gradually become possible with tokenization. However, it's important to note that Nasdaq's tokenized securities trading venue remains on Nasdaq, meaning it's brokered within a compliant, centralized environment. This doesn't mean anyone can trade anonymously and freely on-chain.

Conclusion: Long-term opportunities and industry outlook

Nasdaq's promotion of tokenized securities trading is undoubtedly a major innovation in the underlying technology of securities trading. It marks a crucial step for traditional financial markets towards the blockchain era. From regulatory approval to technological preparation, this transformation will not be achieved overnight. According to Nasdaq's application documents, the relevant blockchain settlement infrastructure may not be ready until the end of the third quarter of 2026. Nasdaq anticipates that, assuming the proposal is approved by the SEC and the DTC's distributed ledger settlement system is launched, US investors could expect to see the first securities transactions settled in token form by the end of the third quarter of 2026.

Investors need to recognize that this is a long-term theme. The GENIUS Act ushers in a new era of stablecoin compliance, and Nasdaq tokenized securities could become the next game-changing milestone. In the coming years, policy advancements and technological milestones related to this theme will continue to be a market focus, fostering cyclical investment opportunities in sectors such as oracles and RWAs. As Nasdaq management has stated, innovation should occur within national market systems to protect investors, not in the unregulated offshore wilderness. As Nasdaq tokenized stocks gradually launch, it will unlock greater potential for institutional capital to participate in on-chain equities.

For example, large institutions can obtain real stock tokens through official channels and then confidently invest them in DeFi to generate returns. This represents a high level of capital that shadow token platforms currently struggle to attract. For the average user, once sovereign-level exchanges offer compliant stock tokens, holding shadow versions without shareholder rights becomes unnecessary.

While the prospects are promising, potential limitations must be addressed. First, in the initial stages, the direct benefits for average investors may be limited. Currently, US retail investors can easily trade stocks through brokerages, and Nasdaq's tokenization will not immediately significantly reduce their trading costs or barriers to entry. While benefits such as 24/7 trading are not necessarily desirable for non-professional investors, they may not want to be constantly trading and experiencing volatility. Smart contracts are also subject to the risk of vulnerabilities and hacking, and if problems arise with tokenized stock contracts, it remains unclear who will bear liability. Furthermore, significant price deviations have been observed in some unregulated tokenized stock transactions abroad, exposing issues of insufficient liquidity and potential manipulation. Under Nasdaq's proposal, these deviations are expected to be reduced because the tokens are backed by real stocks and traditional market makers participate in pricing.

Nasdaq's tokenized stock trading will mark a major milestone in the commercial application of blockchain technology. It signifies that blockchain is no longer confined to the cryptocurrency world, but has truly entered the core landscape of mainstream finance. From an industry perspective, this is an authoritative endorsement of the blockchain and Web3 ecosystem, inspiring more companies and developers to invest in this field. From a financial history perspective, this event may be seen as the starting point for the digital transformation of the traditional securities market, similar to the transition of exchanges from paper-based trading to electronic trading decades ago. For the Web3 community, this is an opportunity to put ideals into practice: concepts like decentralization and tokenization can only unlock their greatest value when integrated with the real economy. While this may not be the most utopian outcome for purist decentralization enthusiasts, it has significantly advanced the process of large-scale blockchain adoption.

Vous aimerez peut-être aussi

Shocking Four.Meme X Suspension: What Happened to the Memecoin Launchpad?

Four.meme: We are in contact with X officials regarding the account issue, and the team is operating normally.