Revenue Sharing and Yield Farming Tokens in 2025: A Deep Dive into Banana Gun ($BANANA) and goodcryptoX ($GOOD)

DeFi isn’t the Wild West anymore. The yield farming boom of 2020-2021 was wild, with projects offering huge APYs. But those yields were often fueled by simply printing more tokens. This approach was unsustainable and led to market instability and big collapses. The 2022 implosion of Terra Luna, which erased over $40 billion in value, was a brutal lesson: a business built on infinite inflation is a house of cards.

By 2025, the market has matured. A “flight to quality” has led to a more resilient model: revenue-sharing tokens. Instead of printing tokens out of thin air, these projects function like real businesses. They earn revenue from their products – like trading fees or service charges – and distribute those profits directly to people who hold their tokens. It creates a healthy cycle: more platform usage means more revenue, which increases demand for the token and creates long-term stability. This is the shift from shaky “Ponzinomics” to sustainable tokenomics.

This new era requires a smarter way to evaluate projects. As detailed in this foundational research on profit-sharing tokens by CoinLaunch, you have to ask the right questions. Does a project generate any revenue? How well are profits shared? Is the product actually being used and growing? Is the project diversified across different blockchains? What’s the potential for the token price to go up? And how many people are the profits being split between?

Banana Gun ($BANANA), a popular Telegram-based trading bot, has become a benchmark for this model. But a new contender, goodcryptoX and its $GOOD token, is emerging with a model designed to improve on what came before. Let’s compare them.

Banana Gun ($BANANA): Performance and Revenue Mechanics

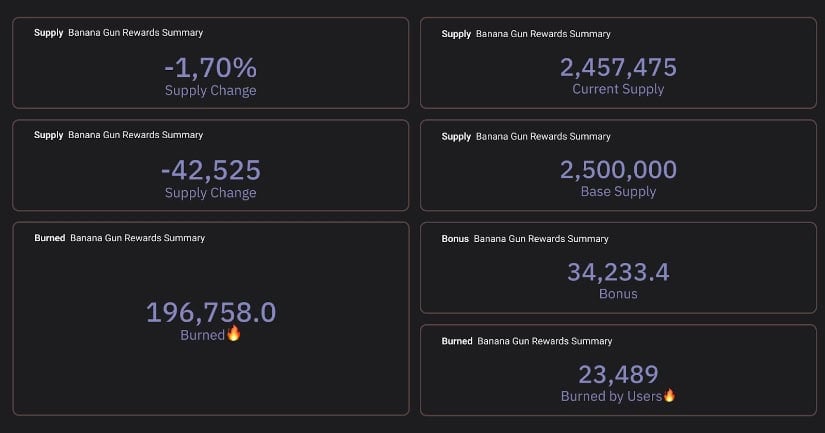

Source: https://dune.com/whale_hunter/banana-gun-supply-tracker

Banana Gun is a multi-chain Telegram bot built for DeFi trading. It offers tools like token sniping, copy trading, and anti-rug protections. Its simple interface on a platform everyone uses, like Telegram, made it incredibly popular. It works on key blockchains like Ethereum, Solana, and Base, letting it capture value from several ecosystems. While they have a web terminal in beta, the bot is what drives most of its users and volume.

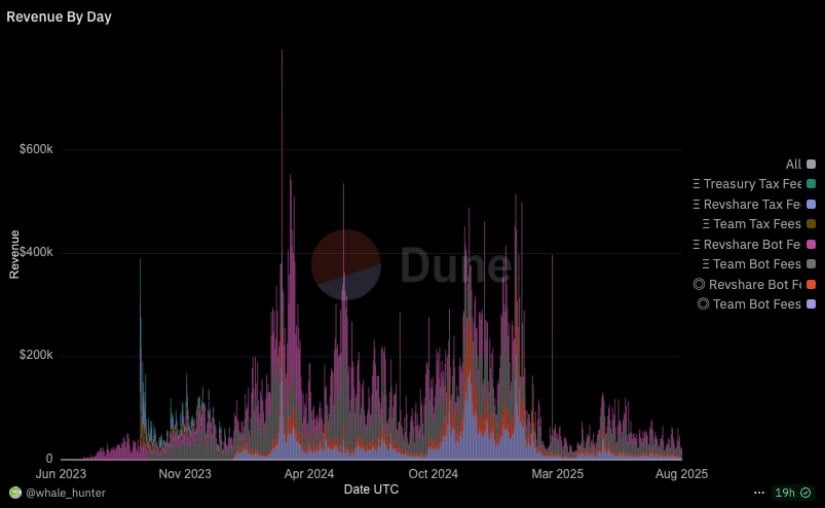

Source: Dune

The project’s business model is straightforward. It generates revenue from a 1% fee on user trades. Of that revenue, a significant 40% is distributed directly to banana gun token holders in real assets, like ETH. This is a critical point. Holders get tangible returns, not just more of the protocol’s own token, which could lose value.

As of mid-August 2025, the banana gun price is around $25. This gives it a market cap of about $100 million and a fully diluted valuation (FDV) of $211 million on CoinGecko. The project has an impressive track record, processing over $3.76 billion in lifetime trading volume. It also has a deflationary burn mechanism, funded by revenue, which has reduced the total token supply by 15.5% (Source: Banana Gun Documentation). This creates consistent upward pressure on the price. The banana gun coin currently delivers an APY of about 9.98% (Source: TokenTerminal), a yield backed entirely by real user activity.

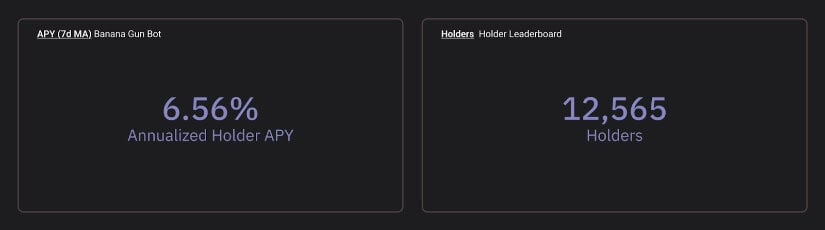

With over 12,000 holders according to TokenTerminal, the model is clearly a success. But that success means the revenue pie is divided into many small slices. The average lifetime earnings per holder is only around $140.

Strengths and Limitations of $BANANA

To get a full picture, let’s analyze Banana Gun using the core ideas from the CoinLaunch research. $BANANA does a few things very well:

- Value Accrual & Fundamental Growth: Sharing 40% of profits in real assets is a great way to deliver value. Its huge lifetime volume and consistent user numbers show it has a strong product that people want to use.

- Ecosystem Exposure: By being on major chains like Ethereum and Solana, it isn’t reliant on a single blockchain’s success. This is a smart multi-chain strategy that reduces risk.

- However, a closer look shows some limitations, especially for new market participants.

- The token’s growth potential is limited by its $211 million FDV. For the price to make 10x from here, its valuation would need to top $2 billion. That would put it in the same league as major crypto projects, like Arbitrum (ARB), Aptos (APT) or Ondo (ONDO), which is a tall order for a specialized trading bot.

- Furthermore, the high demand on its revenue from over 12,000 holders means that even a big jump in platform revenue will only lead to small gains for each individual holder. The 6.56% APY, while solid and sustainable, signals a mature product, not a high-growth one.Banana Gun Annualized Holder APY & Number of Holders. Source: Dune Analytics

What is goodcryptoX? A Look at the Alternative

goodcryptoX isn’t just a simple bot; it’s a comprehensive platform for Web, Android, and iOS. It brings CEX-grade advanced orders and algorithmic trading bots to the DEX ecosystem, a part of the market that has been underserved. The team already has a proven track record, with an existing user base of 400,000 and $5 billion in trading volume on centralized exchanges.

Its product suite – including Dollar-Cost Averaging (DCA), Grid, and Gem Sniper bots – runs across five major chains: Ethereum, Solana, Base, Arbitrum, and BSC. This is a full toolkit for advanced automated trading on-chain. This unique approach has led to explosive growth. Its DEX volume skyrocketed by 9.3x from $366,000 in March to $3.4 million in July 2025. And this happened before they integrated their most anticipated feature: perpetuals DEX trading. This expansion could be a significant volume driver, positioning goodcryptoX as the only platform offering this level of algorithmic trading for both spot and perpetuals on DEXs.

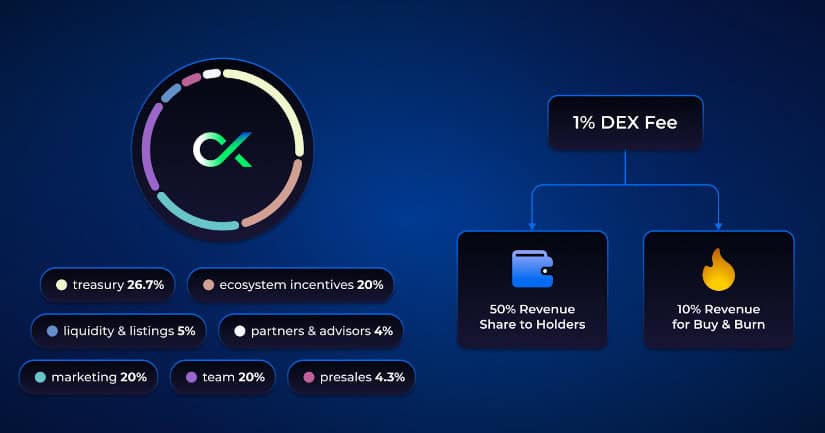

The $GOOD token, launching on September 9, 2025, is built to capture this value. It features a 50% revenue share from a 1% DEX fee, plus another 10% of revenue is used for buybacks and burns. Its tokenomics are designed for stability, with an initial market cap of just $531,000, an FDV of $25 million, and only 2% of the supply unlocked at launch to prevent early sell pressure.

With only about 400 initial holders, the initial revenue dilution is tiny. Based on the project’s own forecasts, the projected APY is 105%, a figure the team anticipates will grow as new features roll out.

Banana Gun vs. goodcryptoX: Head-to-Head

Using the framework from the CoinLaunch research, the strategic differences become clear.

- Value Accrual & Growth: Both have strong revenue-sharing models. However, $GOOD’s model, which combines a 50% share with a 10% burn, is designed to create both direct income and deflationary pressure. Fundamentally, $GOOD’s diverse suite of bots targets a much broader user base than $BANANA’s sniper-focused model, giving it a larger market to capture.

- Ecosystem Exposure: Diversification is key to managing risk. $GOOD is live on five major chains and will soon support DEX futures. It’s a bet on the growth of the entire DeFi trading ecosystem. $BANANA, while on three chains, is more specialized in the token-launch niche, making it more exposed to competition.

- Token Growth Upside: This is the biggest differentiator. Acquiring $BANANA at a $211 million FDV is similar to participating in a mature blue-chip stock; the potential for 10x returns is mathematically small. In contrast, $GOOD’s $25 million FDV presents an asymmetric opportunity. It’s an early-stage project where success could lead to a much higher valuation, offering the kind of upside early participants in $BANANA saw.

- Demand on Revenue: The numbers tell the story. With $BANANA, new revenue is split among 12,000+ people. With $GOOD, it’s initially split among ~400. For every dollar the platform earns, an early $GOOD holder gets an exponentially larger share. This creates a powerful incentive for early adoption.

- APY: The difference between ~7% and ~100% isn’t just about numbers; it’s about the stage of the project. $BANANA’s 6.56% APY reflects a stable, mature business. $GOOD’s projected 102% APY reflects a project in an explosive growth phase, rapidly capturing market share.

BANANA & GOOD Token Comparison

| Metric | Banana Gun ($BANANA) | goodcryptoX ($GOOD) |

|---|---|---|

| Market Cap / FDV | $100M / $211M | $531k / $25M |

| APY | ~6.56% | ~102% (Projected) |

| Revenue Share | 40% in real assets | 50% + 10% burns |

| Holders / Dilution | >12,000 / Moderate | ~400 / Low |

| Ecosystem Exposure | 3 chains / Sniper-focused | 5 chains / Futures / CEX |

| Volume Growth | Steady; $3.76B lifetime | Rapid: $366k to $3.4M (Mar-Jul) |

How to Approach the DeFi Future??

Revenue sharing is a huge step forward for DeFi, grounding protocols in real business fundamentals. Banana Gun’s $BANANA token is a prime example of this model done right. It provides participants with a token that distributes platform revenue and is a model that may appeal to those prioritizing stability.

Yet, as the market evolves, projects like goodcryptoX show how innovation aims to drive different outcomes. With a higher projected APY, lower dilution, and a more diverse product, $GOOD addresses the limitations of established players. It represents a strategic consideration for those comfortable with the risks of an early-stage project. Its token launch on September 9, 2025, is a key event to watch.

Ultimately, the choice between $BANANA and $GOOD depends on an individual’s personal strategy and risk tolerance: stability versus asymmetric upside. For anyone evaluating these projects, the approach is clear: look beyond the hype and analyze the underlying business. The best way to make an informed decision is to do your own research by reviewing the complete CoinLaunch research analysis, exploring the official GOOD token page, and reading the Banana Gun documentation.

A Final Note: Always Do Your Own Research (DYOR)

This article is for informational purposes only and is not investment advice. The crypto market is high-risk, and you could lose your investment. We are not responsible for any of your investment decisions. Always conduct your own thorough research and consult a financial advisor before investing.

This is a sponsored article. Opinions expressed are solely those of the sponsor and readers should conduct their own due diligence before taking any action based on information presented in this article.

Vous aimerez peut-être aussi

Exclusive interview with Sherry, the founding engineer of Aptos: Meta Blockchain "OG"'s technical journey to build a "global trading engine"

Texas Governor Signs SB 21, Becoming the Third State to Establish a Bitcoin Reserve