SharpLink Boosts Reserves with 19K ETH as Corporates Buy the Dip

- SharpLink Gaming increased its Ethereum treasury to 859,853 ETH after raising $76.5 million.

- The company acquired an additional 19,271 ETH at an average price of $3,892 per ETH.

- Since June, SharpLink has earned over 5,600 ETH in staking rewards, worth approximately $23.25 million at current prices.

- It was among the first publicly traded companies to adopt a treasury strategy focused on Ethereum, leading to a stock surge of over 450% in six months.

- Bitmine remains the largest Ethereum treasury holder, having added $250 million worth of ETH amid recent market dips.

SharpLink’s Ethereum Growth Reflects Institutional Shift in Crypto Engagement

SharpLink Gaming announced the expansion of its Ethereum treasury to nearly 860,000 ETH, equating to roughly $3.5 billion, following a successful $76.5 million capital raise completed last Friday. The firm acquired an additional 19,271 ETH at an average cost of $3,892 each, as noted in its latest press release. This marks a significant move by a publicly traded company into ETH holdings, reflecting increasing institutional confidence in the native token of the Ethereum blockchain.

The company’s Ethereum strategy, launched in June, has so far earned 5,671 ETH in staking rewards. Given current ETH prices of about $4,100, these rewards are valued at approximately $23.25 million. By staking its ETH on Ethereum’s proof-of-stake network, SharpLink effectively transforms part of its treasury into a yield-generating asset, earning passive income through validation rewards.

Source: Yahoo FinanceNotably, SharpLink became the first publicly traded company to adopt a treasury strategy centered on Ether on May 27, initially investing $425 million in a private placement of equity shares. The company’s stock price has responded with remarkable growth, surging over 450% in the past six months, signaling robust investor confidence in Ethereum-focused strategies.

Meanwhile, the broader landscape shows dominant institutional players like Bitmine Immersion Technologies, which launched its ETH treasury with a $250 million private investment in June. Recently, Bitmine added another $250 million worth of ETH, bringing its total to approximately 3.24 million tokens—more than 2.7% of the total ETH supply—aiming toward its goal of holding 5%. Despite ETH prices dipping around 14% over the past two weeks, these accumulated holdings suggest strategic accumulation during market lows.

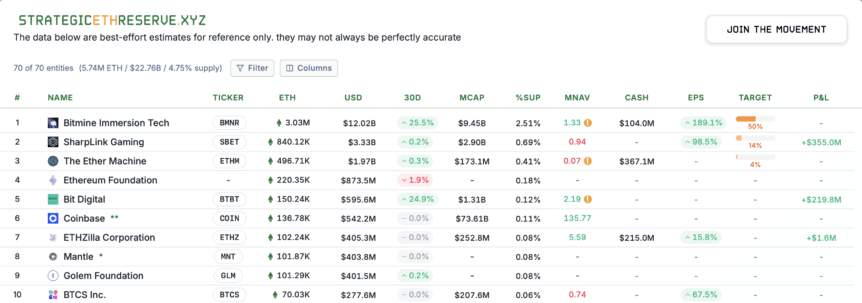

Top 10 Ethereum treasury companies. Source: Strategicethreserve.xyz

Top 10 Ethereum treasury companies. Source: Strategicethreserve.xyz

Owning ETH through staking not only supports network security but also provides a passive income avenue for institutional investors seeking exposure to crypto assets within regulated environments. Ethereum’s proof-of-stake ecosystem remains a focal point for such strategies, as evidenced by firms like Ether Machine, which launched a yield-bearing ETH fund targeting institutional clients with nearly 500,000 ETH holdings.

Currently, 69 Ethereum treasury companies collectively hold over 5.74 million ETH, reflecting a notable shift among institutional investors towards blockchain assets amidst changing regulations and market dynamics.

This article was originally published as SharpLink Boosts Reserves with 19K ETH as Corporates Buy the Dip on Crypto Breaking News – your trusted source for crypto news, Bitcoin news, and blockchain updates.

Vous aimerez peut-être aussi

OpenVPP accused of falsely advertising cooperation with the US government; SEC commissioner clarifies no involvement

HKEX Enforces Regulations on Crypto Treasury Companies