Shiba Inu Price Prediction Weakens, Hedera Stalls at $0.24 – BlockDAG Powers Through with 312K Holders

Shiba Inu has often thrived on hype, but interest has slowed as traders question its long-term direction. Hedera, meanwhile, is advancing with technical upgrades, though many following Hedera (HBAR) updates still wonder if adoption will meet expectations. For those seeking the top crypto to invest in, BlockDAG is quickly becoming the answer. The project has already reached 312,000 holders and is adding more than 1,000 every single day.

That kind of momentum recalls early SHIB or DOGE runs, but BlockDAG (BDAG) is different because it’s backed by working infrastructure, global hardware rollouts, and millions of users mining through the X1 app. This combination of scale and delivery has made it one of the most talked-about projects of 2025. For investors looking past speculation, BlockDAG shows network strength far beyond a simple shiba inu (SHIB) price prediction.

BlockDAG’s Holder Explosion Is Redefining Adoption

BlockDAG is rewriting the playbook on what real adoption looks like. In just months, the project has surged past 312,000 unique coin holders, with over 1,000 new wallets being added every single day. That kind of momentum hasn’t been seen since the early runs of SHIB or DOGE, but unlike those meme-driven spikes, BlockDAG’s rise is built on working infrastructure, live mining devices, and millions already using its X1 mobile app. This is why many now consider it the top crypto to invest in heading into 2025.

What makes the climb stand out even more is that it’s happening before the mainnet launch. The Awakening Testnet is live and running, putting the system under real conditions instead of relying on promises. While other projects built hype that quickly burned out, BlockDAG is showing staying power by letting users test the technology early and see the network’s ability to scale.

The presale has become one of the strongest money-making opportunities this year. Over $410 million has already been raised, including $40 million in the past month alone, roughly $1 million every day. The project is in the latest batch priced at $0.0016 far below the confirmed listing set at $0.05.

With 3 million mobile miners, 20,000 hardware miners shipped, and consistent fundraising momentum, BlockDAG is proving it’s more than hype. It’s being recognized as one of the top cryptos to invest in with real long-term potential.

Shiba Inu Price Prediction: Can the Meme Coin Hold Its Ground?

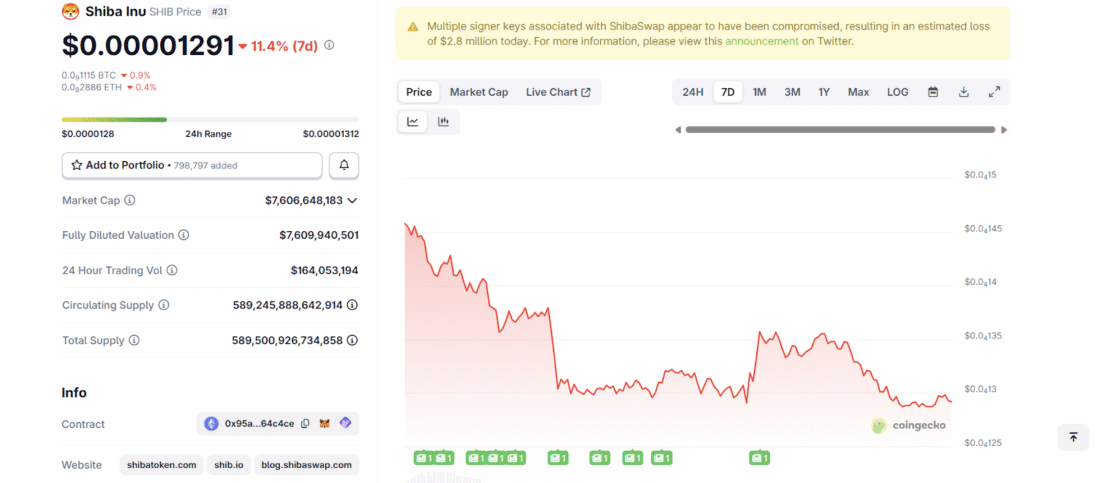

Shiba Inu has had its share of viral growth, but the big question for 2025 is whether that energy can continue. The token is currently priced near $0.000024, showing steady activity but not the explosive rallies of its early days. Analysts following the shiba inu (SHIB) price prediction see near-term upside toward $0.000028–$0.000030 if volumes rise, but warn of dips to $0.000022 if momentum weakens. Unlike its early hype-driven runs, SHIB now leans heavily on token burns and ecosystem updates to sustain interest.

Source- CoinGecko

Even so, the project keeps a loyal community, which supports liquidity and ensures SHIB remains visible on major exchanges. That helps position it as a possible top crypto to invest in, though with limits. Longer-term SHIB price prediction outlooks remain mixed, some forecasts highlight modest growth if burns intensify, while others doubt significant upside without stronger utility. For traders, SHIB works as a speculative play, but it lacks the infrastructure depth that newer projects like BlockDAG bring. This makes it harder to compete with the top crypto options that pair adoption with real-world utility.

Hedera Updates: Price Holds Steady While ETF Hopes Grow

Hedera continues to draw attention for its steady price action and regulatory buzz. At present, the token trades around $0.244, hitting an intraday high of $0.2458 and a low of $0.2365. With a market cap near $10 billion and 42.39 billion HBAR in circulation out of 50 billion max, it remains one of the larger projects by scale. Analysts watching Hedera (HBAR) updates highlight resistance between $0.25 and $0.26, while support is holding near $0.23. Short-term forecasts call for a push toward $0.28 if volume strengthens, but a slide to $0.22 is possible if demand cools.

The larger story, however, is tied to speculation over an HBAR spot ETF. Bloomberg analysts currently put approval odds at 90% by November, after earlier delays. Combined with Hedera’s DTCC listing, this opens the door to significant institutional exposure. Some see this as reason to call HBAR a top crypto to invest in, while others still rate it as a secondary option compared to faster-scaling projects. Long-term HBAR updates suggest cautious optimism, with predictions ranging from steady growth toward $0.30 to bigger moves if ETF approval comes through.

Why BlockDAG Stands Out as the Top Crypto to Invest in

Shiba Inu is still holding attention thanks to token burns and steady trading, with many looking closely at the shiba inu (SHIB) price prediction to gauge whether it can climb back toward $0.000030. Hedera has been steadier, with its price near $0.244 and optimism tied to ETF speculation and infrastructure growth, making Hedera (HBAR) updates worth following closely. Both coins have their strengths, but they also face questions about whether community energy or regulatory progress alone can fuel the next big rally.

BlockDAG, on the other hand, is showing numbers that are hard to ignore. With 312,000 holders, $410 million raised in presale, and daily momentum of 1,000 new wallets, it’s proving adoption can be built by design, not luck. That’s why more investors are calling it the top crypto to invest in for 2025.

Presale: https://purchase.blockdag.network

Website: https://blockdag.network

Telegram: https://t.me/blockDAGnetworkOfficial

Discord: https://discord.gg/Q7BxghMVyu

Disclaimer: This is a paid post and should not be treated as news/advice. LiveBitcoinNews is not responsible for any loss or damage resulting from the content, products, or services referenced in this press release.

The post Shiba Inu Price Prediction Weakens, Hedera Stalls at $0.24 – BlockDAG Powers Through with 312K Holders appeared first on Live Bitcoin News.

Vous aimerez peut-être aussi

A whale/institutional address recently spent $257 million to buy 60,333 ETH

Crypto Market Cap Edges Up 2% as Bitcoin Approaches $118K After Fed Rate Trim