Trader lays down $21 m on S&P 500 call‑structure, betting on a 30 % rally to 9,000 points

Moments before Cryptopolitan reported the Federal Reserve’s decision to cut interest rates by 25bps, someone threw down nearly $21 million on a single trade seemingly out of nowhere, banking on the S&P 500 hitting 9,000 by the end of next year.

The trader paid $20.9 million in premium for the position, which is targeting a rally of more than 30%, even though the S&P 500 is currently hovering around 6,900.

This trade was flagged by Christopher Jacobson, co-head of derivatives strategy at Susquehanna International Group, in a client note seen by Cryptopolitan. “It’s a large trade even by SPX standards,” Jacobson wrote, calling attention to its sheer size.

For the uninitiated, options like these are used daily by both retail and institutional investors, often to hedge risk or go directional.

Trader positions for upside and volatility

Jacobson said the trader appears to be looking for “limited-risk exposure to a significant move higher over the course of the next year and/or an increase in that upside volatility.”

The setup gives this guy a chance to profit even if the S&P 500 doesn’t quite reach 9,000. As long as the index keeps pushing upward, or if volatility spikes, there’s money to be made.

That angle on volatility is especially important, because you see, this year has been unusually quiet, as the market has mostly rallied and broken records multiple times without much drama, though with short-lived dips like the one in April offering brief tension.

That low volatility has made US stock options pricing relatively cheap, so the timing of this trade, right before a flood of tech earnings and a major Fed meeting, might not be as random as we think.

And the US options market has been running hot, with daily volumes hitting 67 million contracts in September, up by 40% from the same time last year, according to data tracked by the Options Clearing Corp. This surge is being driven by both the retail crowd and structured product flows.

Markets react to Big Tech earnings and Powell’s rate signal

That massive $21 million trade came just hours before tech giants Alphabet, Meta, and Microsoft dropped earnings.

Cryptopolitan reported that Alphabet popped 6% in after-hours on strong results, while Meta fell 8% and Microsoft dropped 4%, dragging futures lower.

Futures tied to the S&P 500 dropped 0.2%, the Dow fell 95 points, and Nasdaq 100 futures slipped 0.3%.

The day before, the Dow Jones Industrial Average fell 74 points, or 0.2%, even after touching a record high. The S&P 500 finished flat. The Nasdaq was the only index that moved meaningfully, ending up nearly 0.6%.

That reversal in the Dow came right after Federal Reserve Chair Jerome Powell told reporters, “A further reduction in the policy rate at the December meeting is not a foregone conclusion. Far from it.”

Want your project in front of crypto’s top minds? Feature it in our next industry report, where data meets impact.

Vous aimerez peut-être aussi

Why New and Young Investors See Ozak AI as Their Best Shot at Becoming Crypto Millionaires

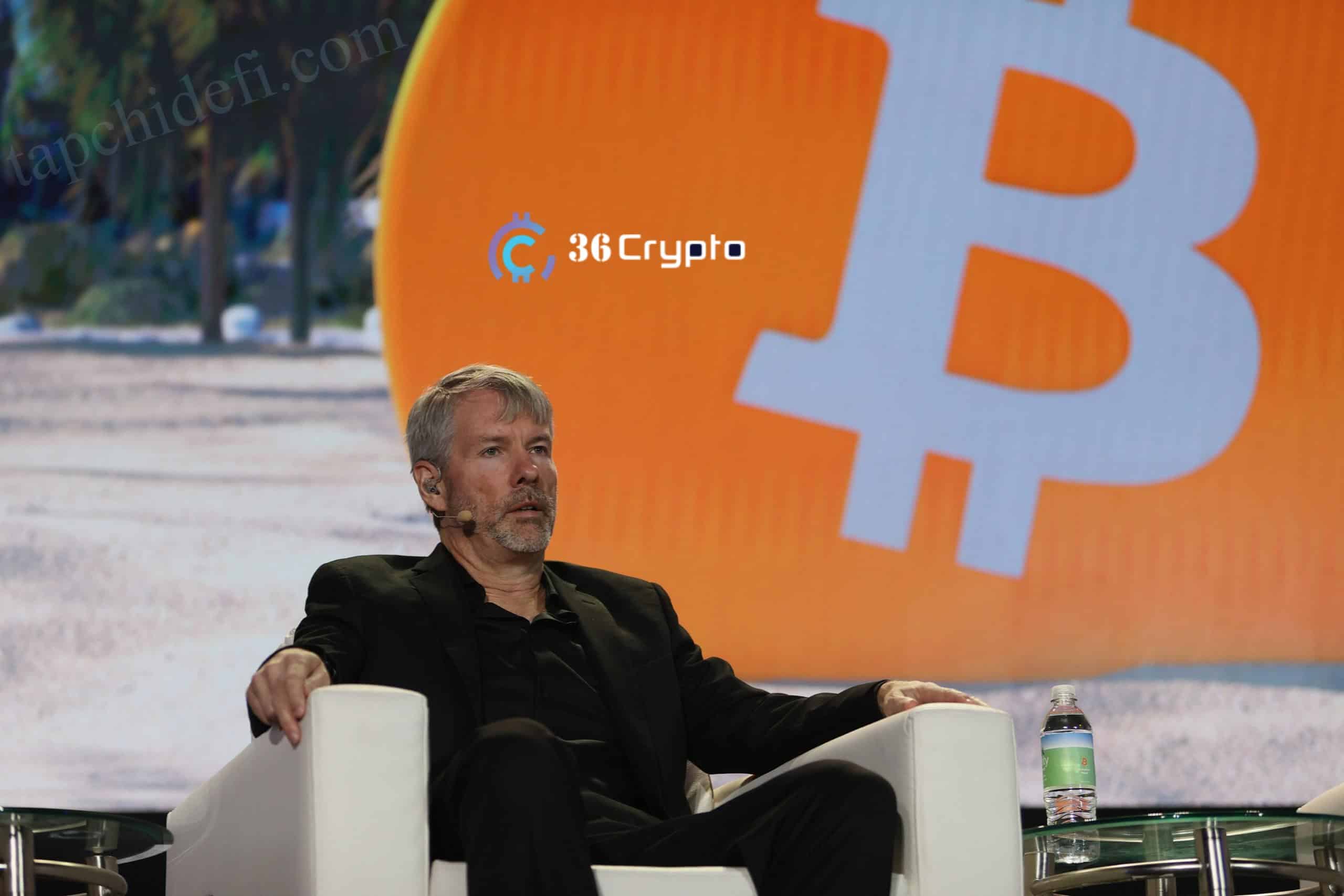

Michael Saylor: My only worry for Halloween this year is not having enough Bitcoin.