Analysis: The bull market is still there, and 10 common market top signals have not appeared

Author: Atlas , Crypto KOL

Compiled by: Felix, PANews

Recently, there have been constant rumors that the "copycat season is over" and market sentiment is generally pessimistic, but there are still some traders or KOLs who believe that this is not the end of this bull market.

Among them, crypto KOL Atlas published an analysis that due to the cyclical behavior of the market, it has witnessed the repetition of many patterns, and the common historical indicators of the top of the Bitcoin bull market have not yet appeared. He also pointed out the 10 signs of the top of the bull market that he has observed over the years.

Atlas believes that none of these 10 market top signals have appeared, and this is not the end of this bull market. When 5 of these signals appear, all positions can be sold.

Sudden interest in cryptocurrencies

The top signal isn’t perfect, but there will come a day when people around you will start asking questions about cryptocurrencies, or randomly ask what tokens to buy.

When you notice this happening, you are likely approaching the final stages of the bull market.

Bullish sentiment is everywhere

At the beginning of the bull market, many people still hold doubts and caution, but as prices continue to rise, this doubt gradually disappears and more and more people become overly optimistic.

When you realize that no one is bearish anymore and everyone believes the market will continue to rise, the market top may be near.

Cryptocurrency enters mainstream media

This again isn’t a perfect top signal, as the cryptocurrency has been in the mainstream news quite frequently.

But when you start seeing it on big entertainment shows like Jimmy Fallon, it’s usually a sign that it’s nearing the top of the cycle.

Good news did not boost prices

Even strong positive news failed to push the market higher. Despite the optimism that permeated the market, prices began to slowly fall.

At the same time, any negative news can cause prices to fall sharply, a clear sign of weakening bullish power.

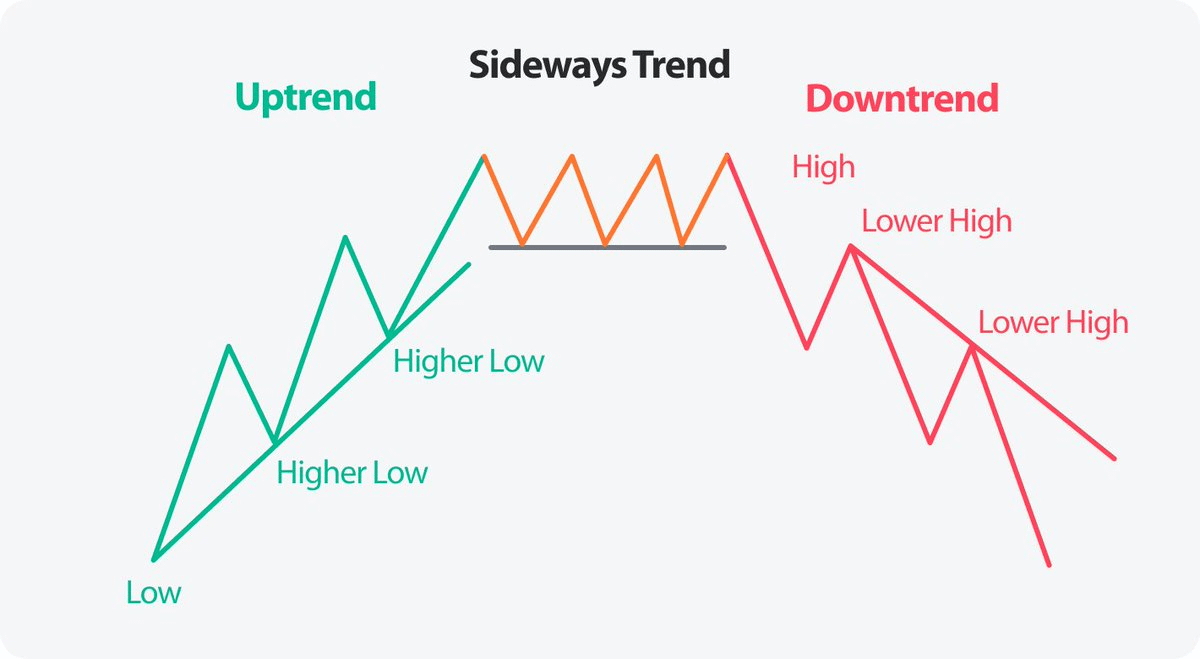

Uptrend breakdown

A more obvious sign is when a steady uptrend begins to break down.

Markets quietly move from making higher highs to forming lower lows – often without drawing much attention at first.

It may look like simple consolidation, but it usually means momentum is fading.

Coinbase ranks first in US app store

When apps like Coinbase climb to the top of the charts, it’s a clear sign that retail FOMO is in full swing.

By then, it is definitely no longer early in the market. The market may still go higher, but this is a strong signal to start locking in some profits.

Showing off the benefits

Crypto Twitter is full of people showing off their gains, luxury cars, watches, and wild parties. Everyone is showing off their gains, making others feel like they are late to the party.

Greed rules the emotions – as they say, “buy when fearful, sell when greedy”.

Resigned

Some newbies get lucky on a few deals and start announcing they want to leave their 9-to-5 jobs.

This is often driven by overconfidence following a big win in a trade.

You’ll hear things like: “I quit my job to work in crypto full time” — typical top-tier vibe.

" Abandoned " project begins operation

Driven by strong hype, even some outdated or abandoned projects began to operate again.

Tokens with no real development or long-forgotten narratives are suddenly gaining attention.

This situation is usually a signal of the late stages of a bull market.

Crazy price predictions are everywhere

Players start touting wild price predictions and telling you to hold on no matter what.

But the reality is that no one knows exactly where the top is.

Focus less on speculating on future prices and maximize your profits.

Related reading: Crypto investment frenzy: Why South Korea has become one of the hottest markets in the world?

You May Also Like

Astonishing Kevin Durant Bitcoin Fortune: A Decade-Long Hold Yields 195-Fold Return

Siemens Patent Mentions IOTA for Renewable Energy NFT Certificates