Bitcoin Miner TeraWulf (WULF) Stock Rallies 21% Amid $9.5B AI Infrastructure Lease

TeraWulf Inc. (NASDAQ: WULF), a US-based bitcoin BTC $114 028 24h volatility: 0.8% Market cap: $2.27 T Vol. 24h: $56.98 B mining and high-performance computing firm, announced a landmark 25-year lease contract worth approximately $9.5 billion with Fluidstack. To facilitate Terawulf’s AI infrastructure integration, the joint venture will deliver 168 megawatts (MW) of critical IT load at its Texas campus.

According to SEC filings, the partnership structure also gives TeraWulf a 51% majority stake and the exclusive right to participate in future Fluidstack-led projects. The venture will be financed through project debt, with Google backing $1.3 billion of Fluidstack’s long-term lease obligations.

The project will expand TeraWulf’s contracted high-performance computing (HPC) platform to over 510 MW of critical IT load, strengthening its reputation as a low-carbon digital infrastructure provider.

The Abernathy facility is slated for delivery in the second half of 2026, and future expansions are already under consideration as both companies seek to leverage existing infrastructure.

Growth Outlook: From Bitcoin Mining to AI Compute Dominance

The long-term deal reflects TeraWulf’s broader transformation from a traditional bitcoin mining company into a diversified AI infrastructure provider. The company now targets between 250 MW and 500 MW of new contracted IT load annually, demonstrating an aggressive growth strategy to match global demand for GPU-intensive AI computing.

TeraWulf’s strategic partnership with Fluidstack, supported by Google’s financial commitment, signals growing convergence between crypto-native mining infrastructure and institutional AI compute workloads.

With Morgan Stanley acting as financial advisor and Paul, Weiss, Rifkind, Wharton & Garrison LLP providing legal counsel, the transaction marks one of the most significant HPC infrastructure commitments by a US digital asset firm to date.

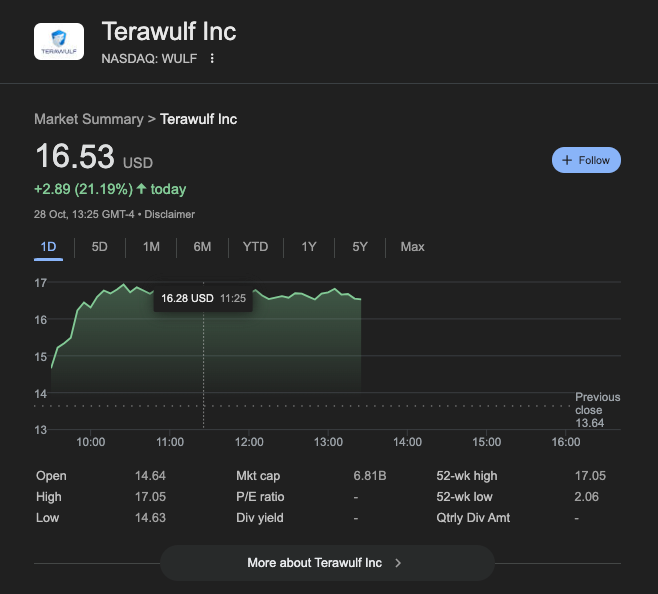

TeraWulf’s (WULF) stock price rose 22.88% on Oct. 28, trading at $16.76 at the time of writing.

Terrawulf (WULF) Stock Price action, Oct. 28, 2025 | Nasdaq

The post Bitcoin Miner TeraWulf (WULF) Stock Rallies 21% Amid $9.5B AI Infrastructure Lease appeared first on Coinspeaker.

You May Also Like

SEC Approves Generic Listing Standards for Crypto ETFs

US, UK to collaborate on AI, quantum computing, nuclear energy development

US President Donald Trump and UK Prime Minister Keir Starmer signed a memorandum of understanding on Thursday during Trump's state visit to the United Kingdom. The United States and the United Kingdom signed a memorandum of understanding on Thursday to jointly develop artificial intelligence, nuclear energy, telecommunications and quantum computing for a wide range of uses including space travel, military defense, targeted biomedical drugs and medical procedures.The MOU, which is not legally binding and changes no existing agreements between the two countries, proposes joint research initiatives between a host of government departments and agencies in both countries to study these emerging technologies.The two countries will form a task group to develop quantum computing hardware, software, algorithms and interoperability standards, according to the MOU.Read more