CoinFund leads $10m raise for layer 1 datachain platform Irys

Irys has raised $10 million in a Series A round led by CoinFund as it looks to unlock value across the $3 trillion data economy.

- CoinFund led the $10 million Series A funding round for Irys, a layer 1 datachain platform.

- The raise brings Irys’ funding to $20 million, with the platform looking to help unlock onchain data value in a $3 trillion market.

Irys, a programmable datachain platform looking to address fundamental inefficiencies in the $3 trillion data market, said it secured a $10 million Series A round from prominent venture capital firms and investors.

According to details Irys shared with crypto.news on Aug. 21, crypto native investment firm CoinFund led the funding round, with participation from Amber Group, Hypersphere, Tykhe Ventures, WAGMI Ventures, Varrock Ventures, Breed VC and Echo Group. The latest raise brings Irys’ capital injection to $20 million.

With eyes on the rapidly expanding data economy, Irys is pioneering a layer 1 datachain infrastructure that will allow users to tap into the value that comes with the data they generate. To bring this to reality, Irys is looking at a blockchain platform that combines a data layer and native smart contracts execution layer.

Leveraging the two, with artificial intelligence integration rising, allows for a platform that enables users to embed instructions on licensing, monetization and access control in data, a design that means data can actively generate value for its creators.

An “AWS moment” for onchain data

Irys, which launched the testnet of its programmable datachain in January 2025, offers Ethereum Virtual Machine-compatible execution and has seen notable growth with more than 80 strategic partners and over 600 million data transactions processed. The platform also boasts over 4 million active wallets.

Team Irys plans to use the funding to expand its infrastructure, team and strategic partnerships. Its eyes are on accelerating institutional adoption of the datachain economy ahead of its mainnet launch.

As Einar Braathen, partner at CoinFund notes, Irys could be the “AWS moment” of the datachain ecosystem. His comment references the disruptive impact that the cloud service Amazon Web Services has had across the market.

You May Also Like

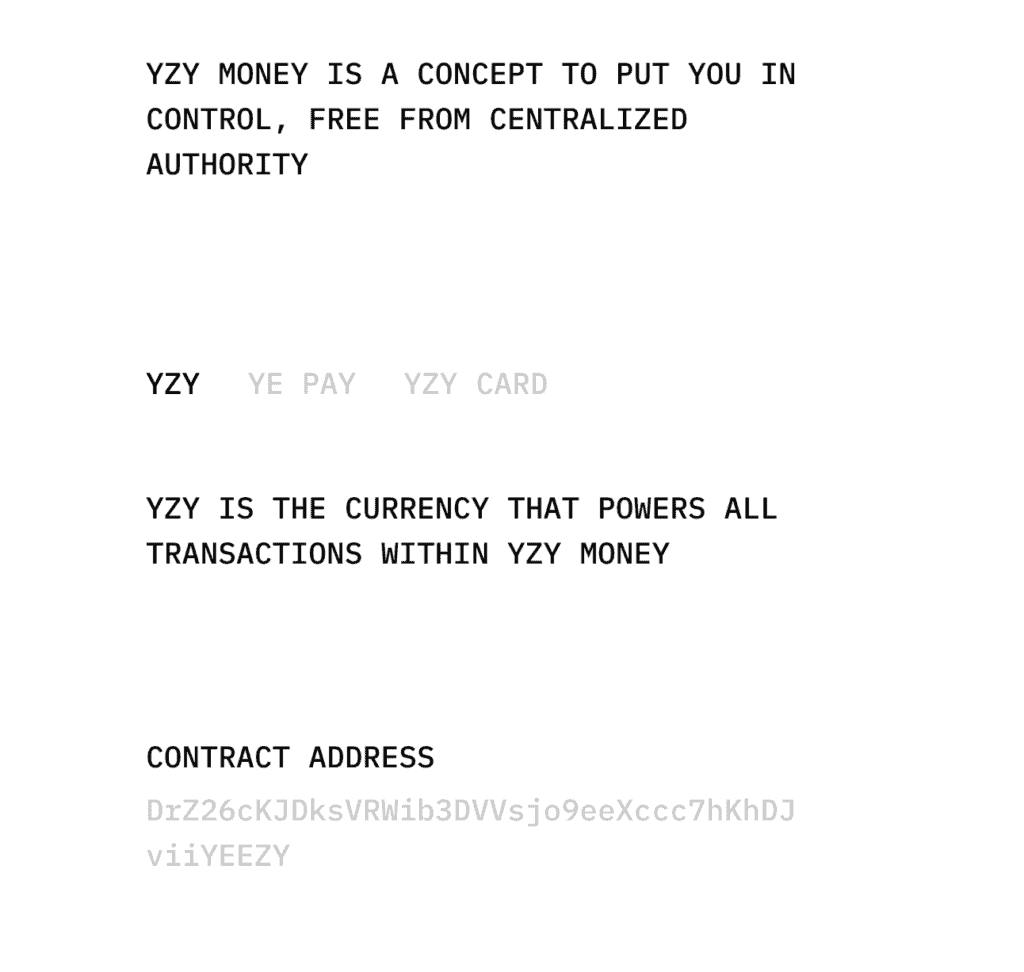

Kanye West Unveils Official “YZY Money” Ecosystem on Solana

US Government Wallet Acquires Ethereum (ETH) from Coinbase! Here’s Why!