Hong Kong Secretary for Justice: Any entity issuing stablecoins pegged to the Hong Kong dollar, whether in Hong Kong or outside Hong Kong, must apply for a license.

PANews reported on October 29th that, according to AASTOCKS, Hong Kong Secretary for Justice Lam Ting-kwok stated that virtual asset trading is becoming increasingly active, with most transactions conducted through virtual asset trading platforms. Many investors deposit virtual assets on these platforms to earn returns. In recent years, digital assets pegged to fiat currencies, known as "stablecoins," have rapidly emerged. Anyone issuing fiat currency stablecoins in Hong Kong or claiming to be pegged to the Hong Kong dollar must apply for a license from the Monetary Authority of Hong Kong. Such individuals must comply with regulations regarding reserve asset management and redemption, including properly segregating client assets and maintaining sound stability mechanisms.

Vous aimerez peut-être aussi

Privacy is ‘Constant Battle’ Between Blockchain Stakeholders and State

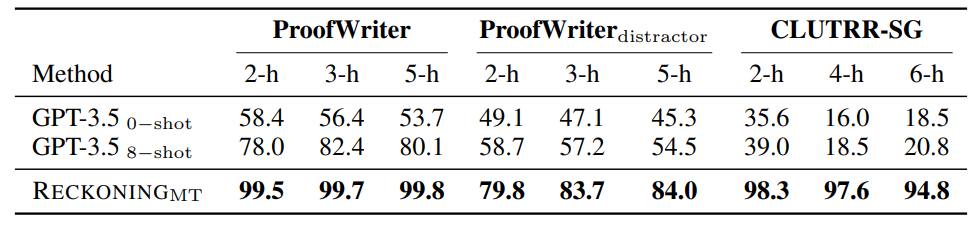

Technical Setup for RECKONING: Inner Loop Gradient Steps, Learning Rates, and Hardware Specification