2026-02-19 Thursday

Crypto News

Indulge in the Hottest Crypto News and Market Updates

5 Best Cryptos to Buy Now as Risk Appetite Contracts (2026 Watchlist): DeepSnitch AI, HYPE, SOL, & More

Enjoy the videos and music you love, upload original content, and share it all with friends, family, and the world on YouTube.

Share

Author: Blockchainreporter2026/02/19 20:40

Worrying Outlook on the Solana (SOL) Network! Is It All Over?

According to Santiment, confidence in Solana is declining due to network issues and weak technical indicators. Is SOL over? Continue Reading: Worrying Outlook

Share

Author: Bitcoinsistemi2026/02/19 20:35

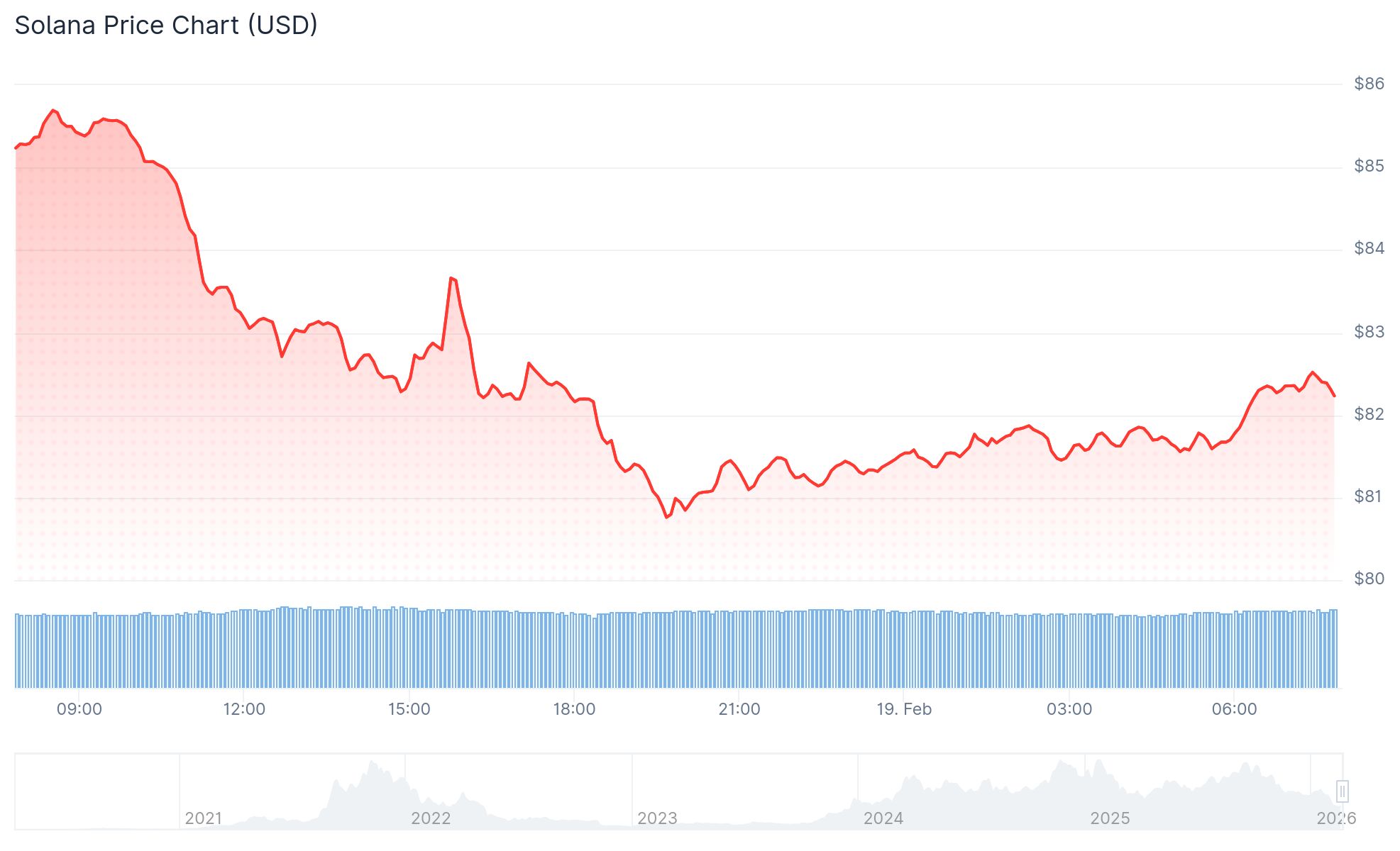

Cracks in Solana’s (SOL) Chart: Is a Sub-$80 Move the Next Chapter?

The post Cracks in Solana’s (SOL) Chart: Is a Sub-$80 Move the Next Chapter? appeared on BitcoinEthereumNews.com. Solana (SOL) slips to $82 with a 3% loss. $11.

Share

Author: BitcoinEthereumNews2026/02/19 19:38

Solana weakens as liquidations rise and sentiment cools

Solana (SOL) has fallen below $82 as selling pressure and risk aversion increased. Rising liquidations show leveraged traders are exiting positions. $80 support

Share

Author: Coin Journal2026/02/19 19:18

$209B Altcoin Sell-Off Puts Ethereum, SOL, XRP at Risk

The post $209B Altcoin Sell-Off Puts Ethereum, SOL, XRP at Risk appeared on BitcoinEthereumNews.com. Ethereum and Solana price coiling within a narrow range could

Share

Author: BitcoinEthereumNews2026/02/19 18:30

Solana Faces Capital Outflows And Slowing On Chain Activity

Warning signals are multiplying around Solana. While SOL struggles to stabilize above a key technical threshold, derivatives market data show a clear retreat o

Share

Author: Coinstats2026/02/19 17:05

From a tech engineer to a crypto billionaire: A deep dive into the personal wealth of Solana founder Toly.

This article is from: Arkham Translator|Moni Anatoly Yakovenko (@toly) is the creator of the Solana blockchain and has become a leading figure in the blockchain

Share

Author: PANews2026/02/19 16:56

Top Reasons Why Solana (SOL) Price Is Preparing for a Short Squeeze to $100

The post Top Reasons Why Solana (SOL) Price Is Preparing for a Short Squeeze to $100 appeared first on Coinpedia Fintech News Solana’s price is stuck in a crucial

Share

Author: CoinPedia2026/02/19 16:54